Liquidations

Maintain lending market health

Overview

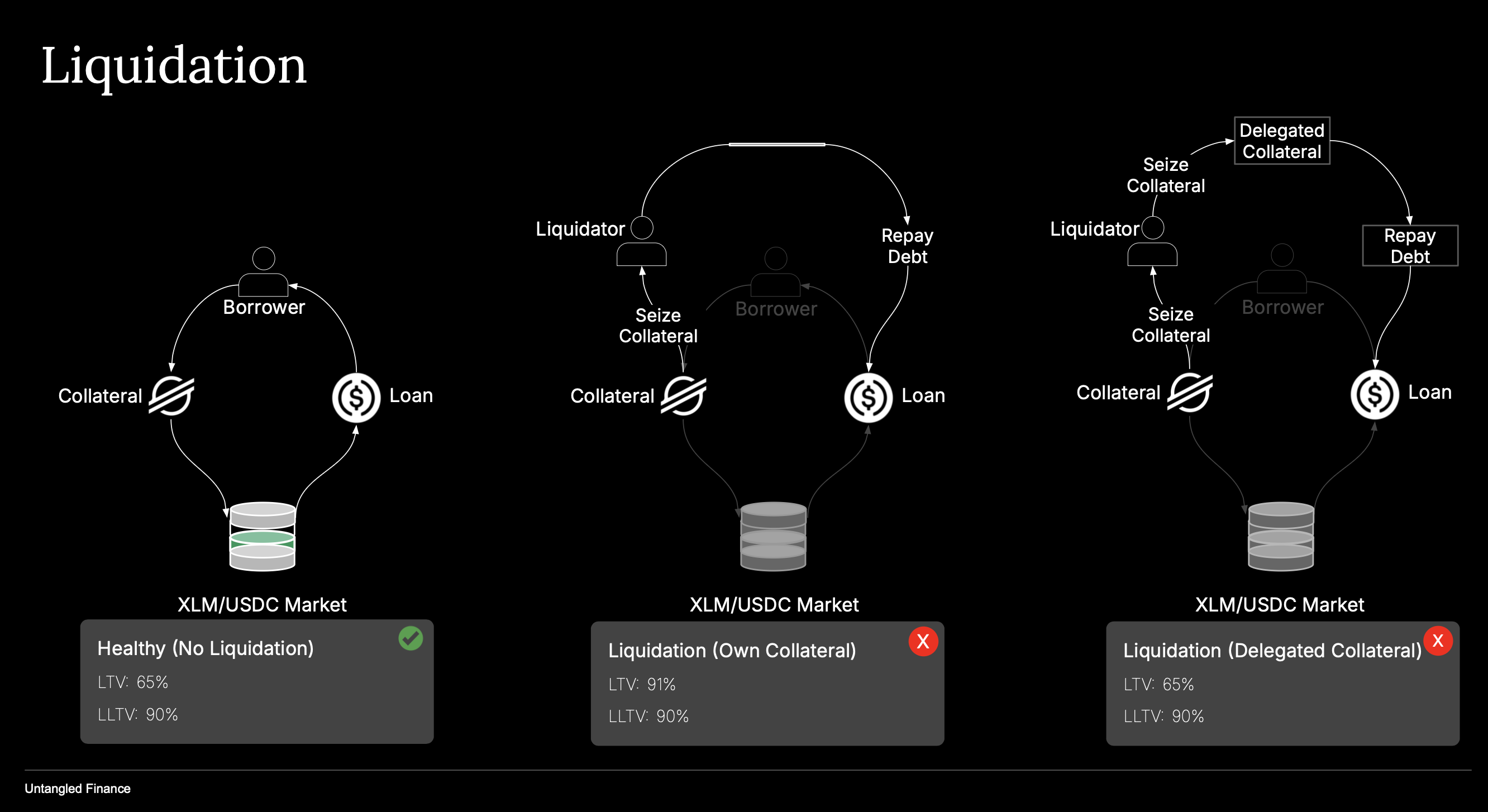

If a borrower’s position exceeds the Liquidation Loan-To-Value (LLTV) threshold, anyone may trigger liquidation.

The liquidation mechanism is deterministic, value-based, and enforces a strict priority between borrower-posted collateral and delegated collateral.

Liquidations operate entirely on-chain and rely on oracle pricing and the market’s IRM-derived debt price.

Liquidation Conditions

A borrower becomes liquidatable when:

borrowed_value > collateral_value × (LLTV / 10_000)

where:

borrowed_value = debt_shares × debt_price

collateral_value = (posted_collateral + delegated_collateral) × oracle_price

Delegation fees accrue off-balance-sheet and are not netted out of delegated collateral when computing collateral value, borrow capacity, or liquidation thresholds.

Once the threshold is breached, the position becomes eligible for liquidation.

Liquidatable Amount

When a position is liquidatable, the protocol permits liquidation of the entire borrowed value.

The system does not compute a partial “safe” liquidation amount; instead, liquidators may choose how much of the position to liquidate in each transaction.

Order of Collateral Seizure

Liquidation proceeds in a strict and deterministic order:

-

Borrower’s own collateral first:

Collateral posted directly by the borrower in the Lending Market is seized and transferred to the liquidator. -

Delegated collateral second (if required):

If borrower-posted collateral is insufficient to cover the repaid debt plus liquidation bonus, the shortfall is recorded as a pending seize against the borrower’s allocated delegation. -

Deferred settlement via Collateral Vault:

The Collateral Vault later settles this pending seize vialiquidate_allocation, updating allocation balances and fee accounting accordingly.

This structure ensures:

- Borrowers absorb losses on their own assets first.

- Delegated collateral acts strictly as a secondary buffer.

- Losses do not propagate beyond the borrower’s specific delegation relationships.

Partial Liquidation

Liquidation is optional and partial by choice, not by protocol constraint.

- A liquidator may repay any amount up to the borrower’s total outstanding debt.

- After a partial liquidation, the position remains open with reduced debt and reduced collateral.

- The position may remain liquidatable if it still exceeds LLTV.

This enables gradual deleveraging and avoids forcing full position closure in a single transaction.

Liquidation Bonus

The liquidation bonus (in basis points) defines the incentive paid to liquidators. The liquidator receives collateral worth:

repaid_value × (1 + bonus_bps / 10_000)

Collateral value is determined using the oracle price at the time of liquidation.

The bonus compensates liquidators for execution risk and timing uncertainty.

Settlement and Accounting

- The liquidator transfers the repaid loan asset to the market contract.

- Corresponding debt shares are burned, reducing total outstanding debt.

- Seized borrower-posted collateral is transferred directly to the liquidator.

- Any shortfall against delegated collateral is recorded as a pending seize.

- When settled, the Collateral Vault updates allocation balances and accrued fees.

- Market and borrower storage is updated to reflect new debt and collateral states.

Key Parameters

| Parameter | Description |

|---|---|

| Liquidation Threshold (LLTV) | Determines when a position becomes liquidatable. |

| Liquidation Bonus (bps) | Incentive multiplier paid to liquidators in collateral. |

| Oracle | Provides the reference price for collateral valuation. |

| Collateral Vault (optional) | Source of delegated collateral used only after borrower collateral is exhausted. |

Summary

Liquidation in OctoLend is deterministic and strictly prioritized:

- Optional & partial: Liquidators choose how much debt to repay per transaction.

- Prioritized: Borrower-posted collateral is always seized before delegated collateral.

- Deterministic: All valuation relies on oracle prices and IRM-derived debt pricing.

This design contains credit losses within each market and delegation relationship, aligning incentives between borrowers, delegators, and liquidators.