What is Untangled Loop?

Untangled Loop lets you open leveraged long/short positions on Stellar by automating looping strategies on top of:

- Spot liquidity (via Aquarius AMM, other spot exchanges to follow)

- Money markets (via Blend and OctoLend, later)

All positions are created by combining swaps + borrow/lend into a single atomic transaction using flash loans.

Untangled Loop builds positions by automating looping strategies through Blend flash loans, executed with a swap via Aquarius.

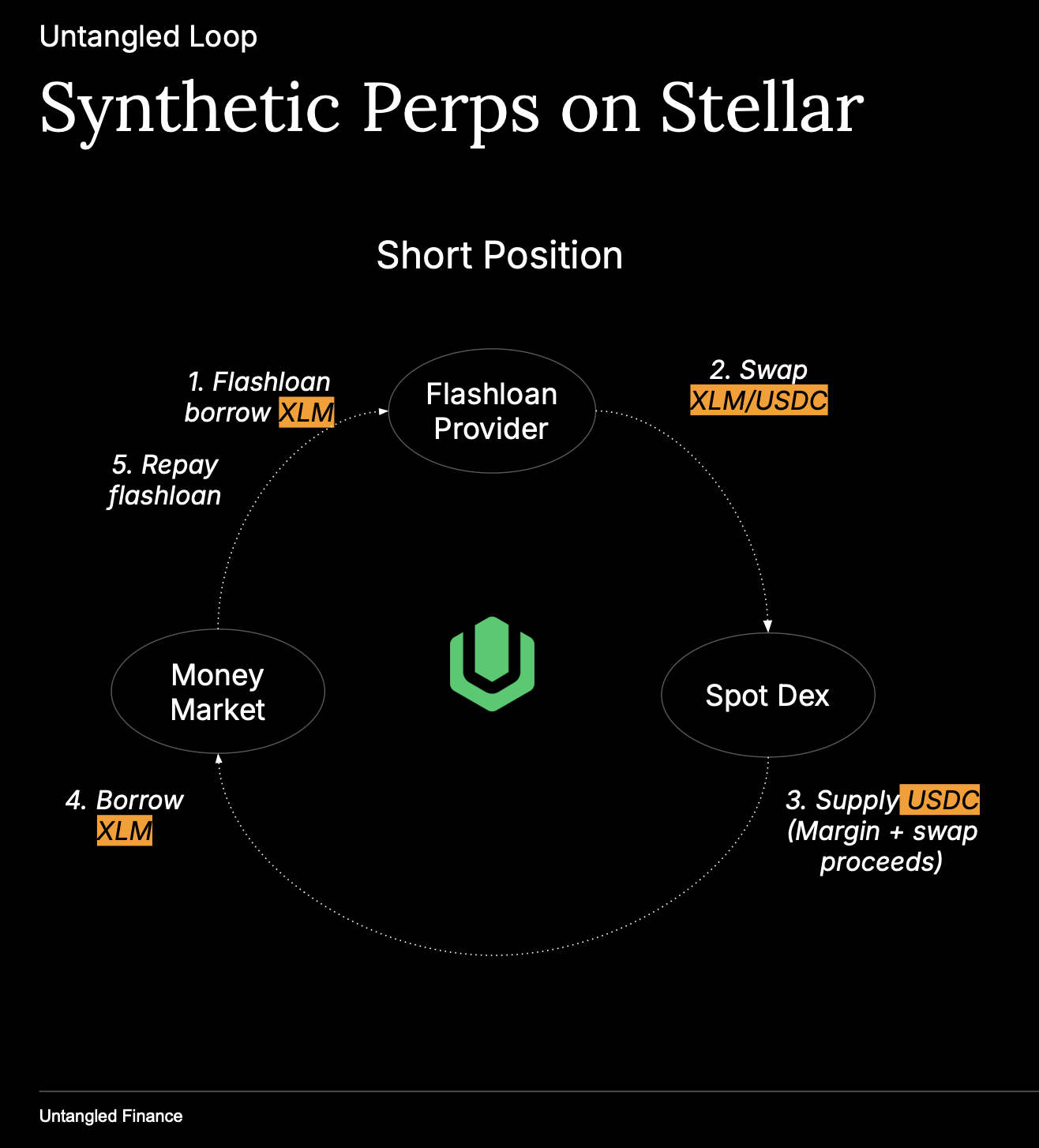

At a high level, to open a position, Untangled Loop:

- takes a flash loan (Base or Quote depending on long/short),

- swaps on Aquarius,

- supplies the swapped asset as collateral on Blend,

- borrows the other asset on Blend,

- repays the flash loan — all atomically.

When closing a position, Loop reverses the sequence using a flash loan to repay debt and withdraw collateral in the same transaction.

Current implementation uses variable-rate markets (Blend), and swaps route via Aquarius.

Why is this design superior?

You can trade on existing on-chain liquidity

Untangled Loop builds positions on top of spot + money markets. By sourcing swaps from Aquarius and borrowing/lending through Blend, Loop can facilitate larger trades while minimizing unnecessary fragmentation between venues.

Funding is derived from money market rates

Funding (shown as APY / ROE in the UI) is determined by the difference between supply APR and borrow APR on Blend. This can be positive or negative depending on current utilization and rate curves.

Composable by design on Stellar

A pair can be supported when there is:

- a swap route (Aquarius), and

- a lending market for the two assets (Blend).

Automated looping

Looping is the DeFi-native way of creating leveraged exposure on-chain. Users borrow against collateral, swap the borrowed amount, and re-supply to increase exposure. Traditional manual loops become inefficient after many repetitions due to overcollateralization constraints (LTV / liquidation thresholds), Untangled Loop automates this using flash loans.

Who’s this for?

Loopers

Users who already do manual or automated “loops” (recursive lending and borrowing) can use Loop to open positions with clear metrics like liquidation price, health factor, mark price, leverage, and net funding.

Traders

Directional traders can open long/short exposure without an order book. Positions are built from money market legs + spot swap execution, enabling both directional trades and rate-driven strategies.