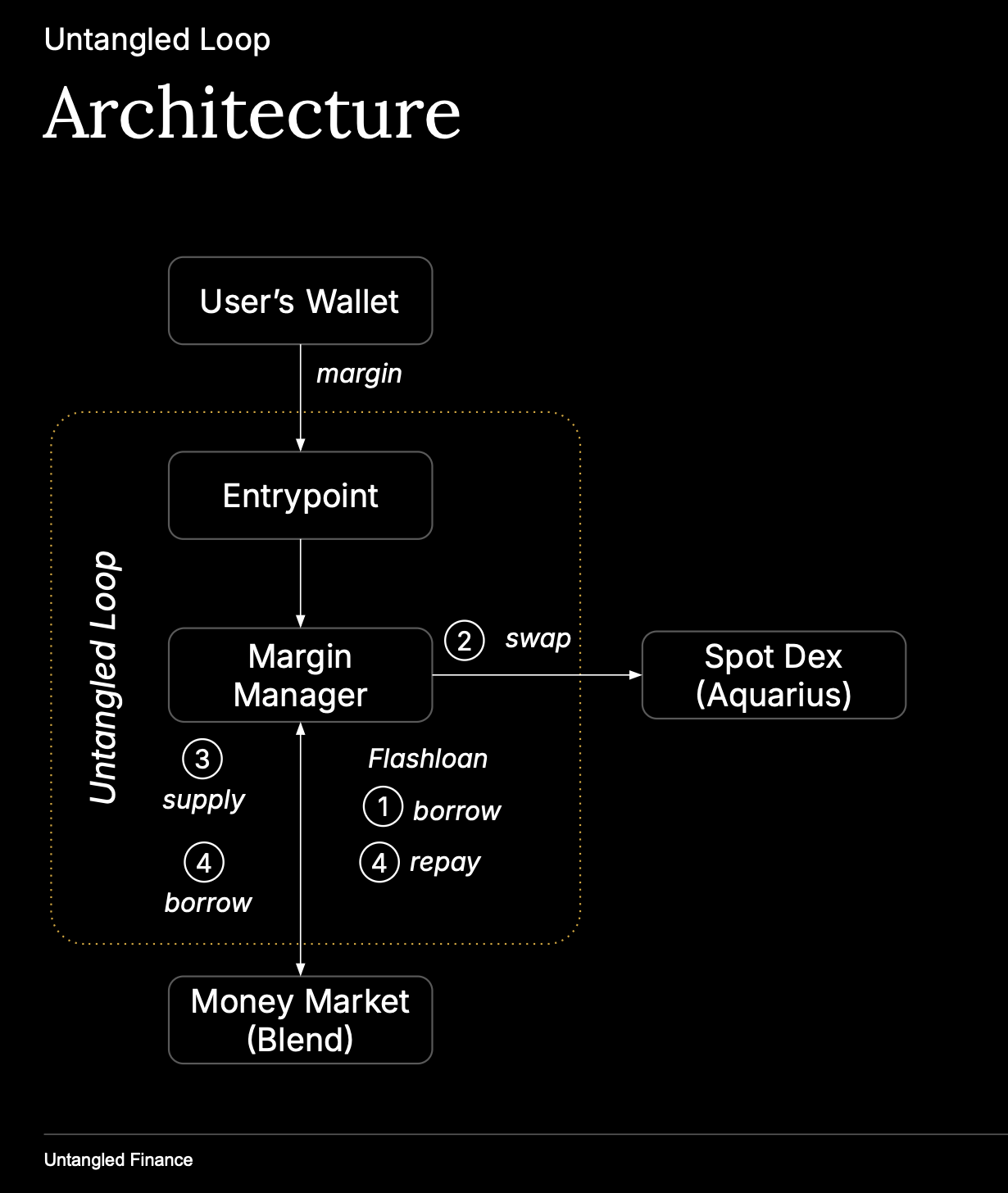

Architecture

Position mechanics

Untangled Loop is deployed as two Soroban contracts working together:

- Entrypoint: per-pair strategy initiator (e.g., XLM/USDC). Builds the flash loan + request bundle.

- MarginManager: flash-loan callback handler. Executes swaps via Aquarius and leaves swapped tokens with the caller for Blend requests.

Architecture (open position)

- User calls

Entrypoint.open_long()orEntrypoint.open_short() - Entrypoint calls

MarginManager.set_swap_config(...) - Entrypoint calls Blend Pool

flash_loan(caller, FlashLoan{...}, requests) - Blend transfers flash loan tokens to MarginManager and calls

MarginManager.exec_op(...) - MarginManager:

- transfers flash-loaned tokens to caller

- swaps via Aquarius using the configured route and

min_amount_out - clears swap config

- Blend executes

requests(supply collateral, borrow, repay) - Position is opened

Long position

A long Base/Quote position means:

- Collateral = Base

- Debt = Quote

- Profit when Base/Quote increases

Quote currency as margin

If a trader longs Base using Quote as margin, Loop:

- flash loans Quote

- swaps Quote → Base

- supplies Base as collateral

- borrows Quote

- repays flash loan

This is implemented by:

Entrypoint.open_long(...)- swap config token_out = Base

- Blend requests:

SUPPLY_COLLATERAL(Base),BORROW(Quote),REPAY(Quote)

Base currency as margin

If a trader longs Base using Base as margin, Loop:

- flash loans Quote

- swaps Quote → Base

- supplies (swapped Base + margin Base) as collateral (depending on

margin_from_quote) - borrows Quote

- repays flash loan

The contracts support margin being either side of the pair via

margin_from_quoteandinitial_margin.

Short position

A short Base/Quote position means:

- Collateral = Quote

- Debt = Base

- Profit when Base/Quote decreases

Quote currency as margin

If a trader shorts Base using Quote as margin, Loop:

- flash loans Base

- swaps Base → Quote

- supplies (swapped Quote + margin Quote) as collateral

- borrows Base

- repays flash loan

This is implemented by:

Entrypoint.open_short(...)- swap config token_out = Quote

- Blend requests:

SUPPLY_COLLATERAL(Quote),BORROW(Base),REPAY(Base)

In the UI example (XLM/USDC short):

- User inputs USDC as margin

- Loop borrows/owes XLM (debt) and holds USDC as collateral

- Leverage controls how much Base is flash loaned and swapped into additional collateral

Base currency as margin

If a trader shorts Base using Base as margin, Loop:

- flash loans Base

- swaps Base → Quote

- supplies swapped Quote as collateral

- borrows Base (reduced by margin if margin is Base)

- repays flash loan