App

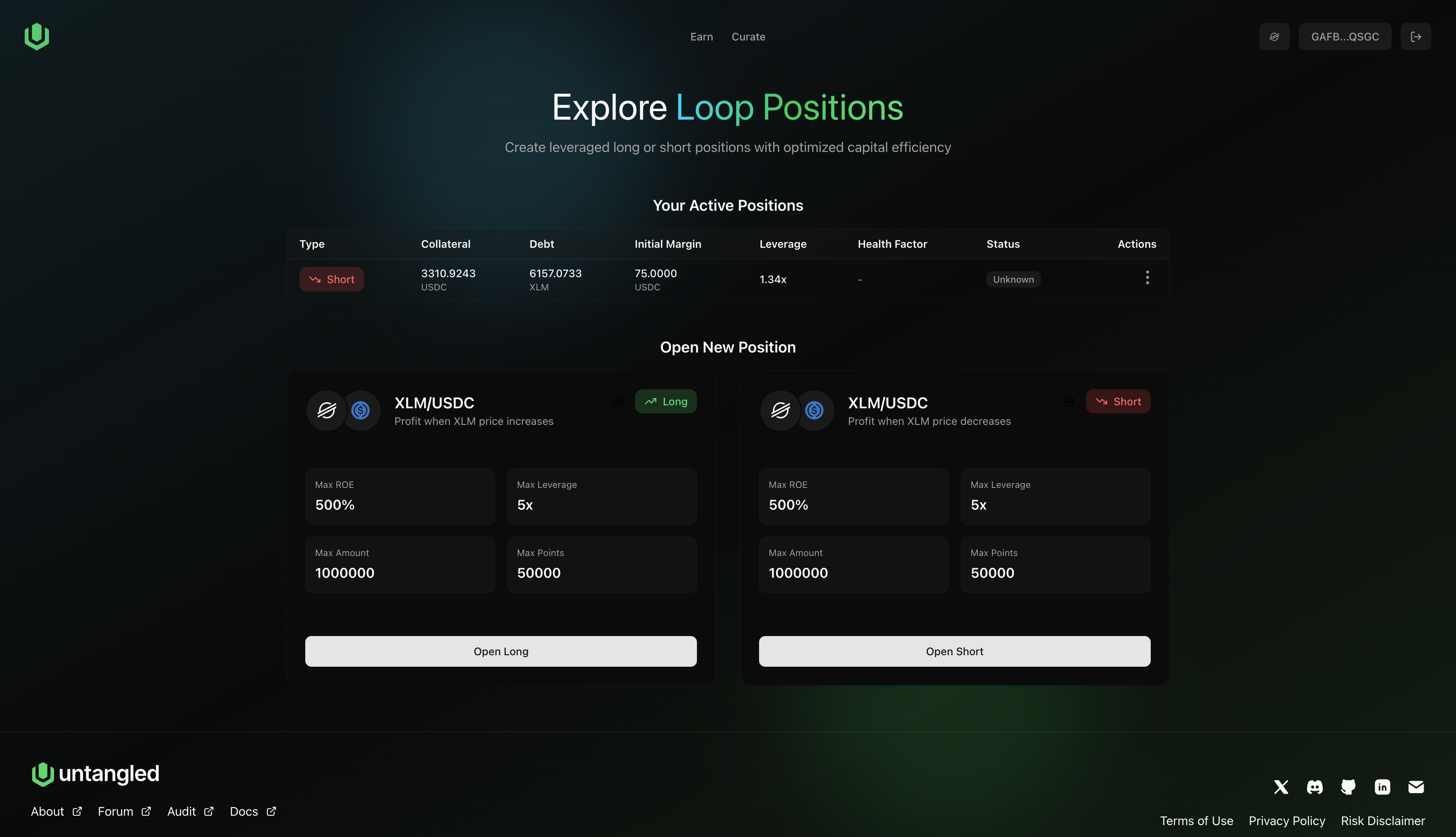

This page explains the current Untangled Loop trading UI (example: opening a short XLM position).

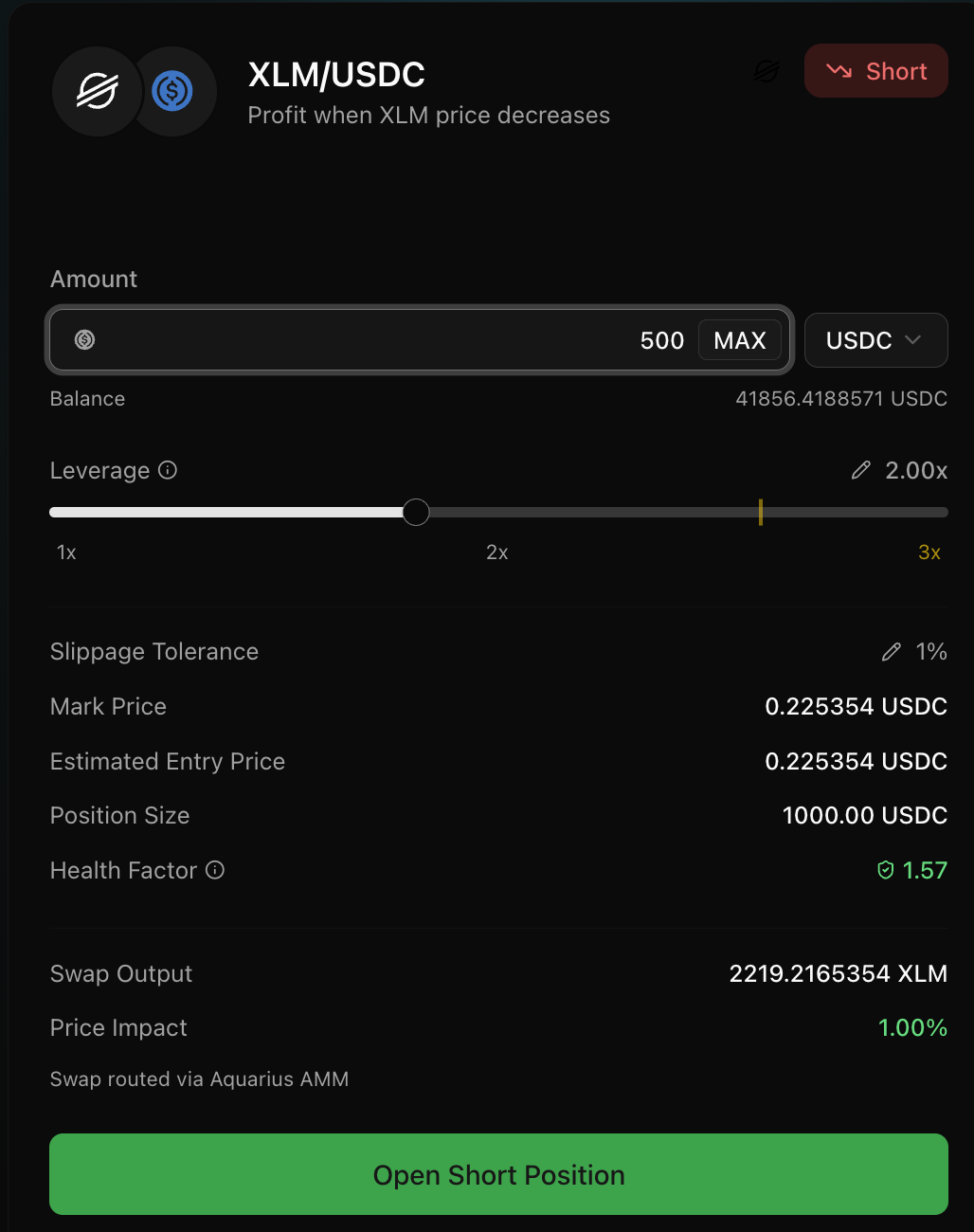

Trade builder (left panel)

Pair and direction

- Pair: XLM/USDC

- Direction: Short (profit when XLM price decreases)

Inputs

- Amount: your margin input

- Leverage slider: sets effective leverage (constrained by money market parameters)

- Slippage tolerance: affects swap min-output protections

Key previews

- Mark price: reference pricing for health/liquidation context

- Estimated entry price: implied execution price for the swap leg

- Position size

- Health factor / liquidation buffer (risk proxy)

- Swap output

- Price impact (spot execution impact)

Action

- Approve token (if needed)

- Submit trade

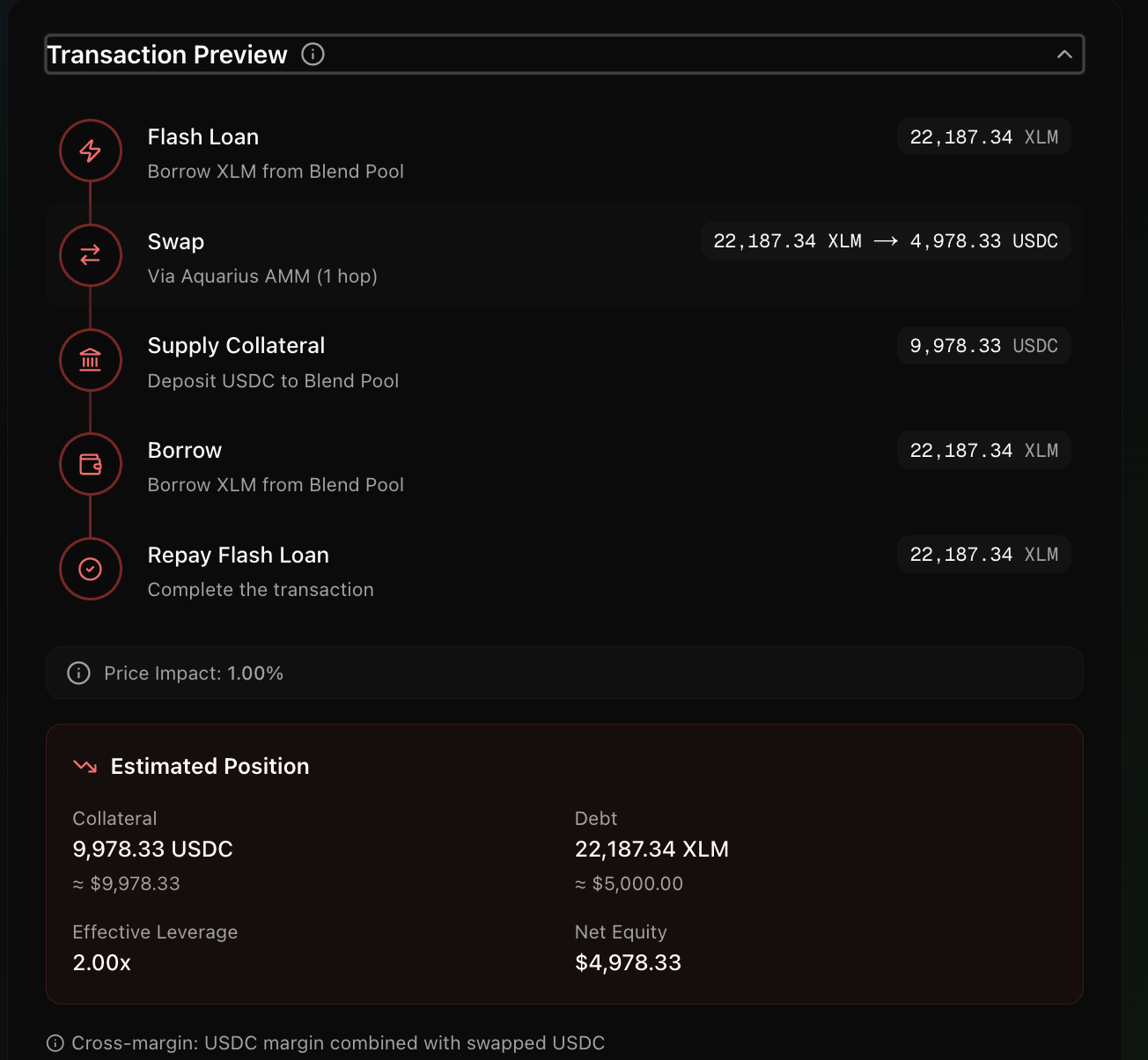

Transaction preview (right panel)

The UI decomposes the single atomic transaction into steps:

-

Flash loan

Borrow XLM (or USDC depending on long/short) from Blend Pool. -

Swap

Execute Aquarius route (1 hop or multi-hop). -

Supply collateral

Deposit swapped asset as collateral on Blend. -

Borrow

Borrow the opposite asset to form the position’s debt. -

Repay flash loan

Complete the flash loan repayment in the same transaction.

This preview is meant to make the mechanics explicit: your “position” is just collateral + debt on Blend.

Estimated position box

Shows the post-trade state:

- Collateral asset + amount

- Debt asset + amount

- Net equity estimate

- Effective leverage estimate

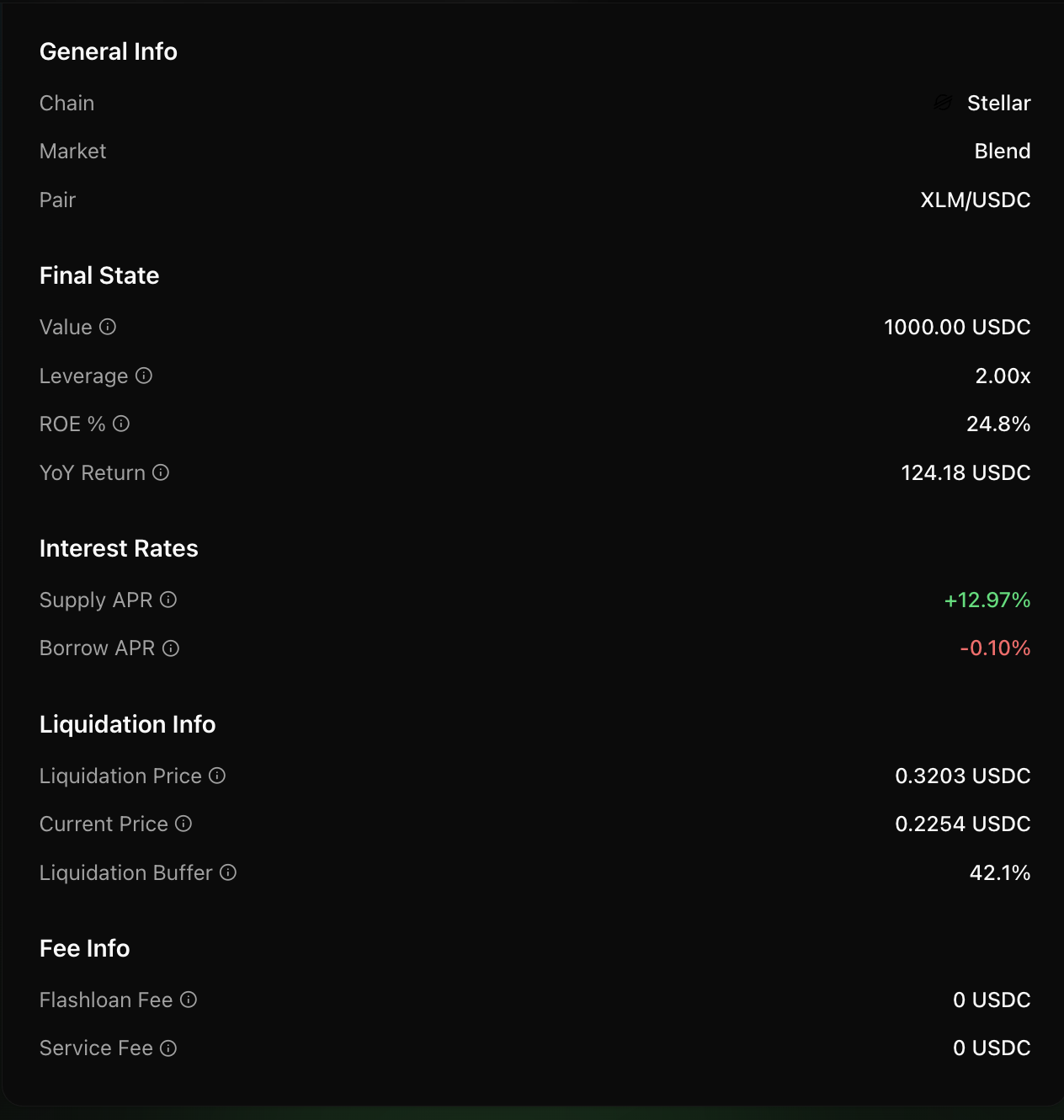

Rates & liquidation

The UI surfaces:

- Supply APR (collateral leg)

- Borrow APR (debt leg)

- Liquidation price + buffer

These values can change with utilisation and market conditions.