How it works

Untangled Loop synthetizes long/short exposure using spot + money markets, automated via flash loans.

At a high level:

- Long Base means: you end up with Base collateral and Quote debt

- Short Base means: you end up with Quote collateral and Base debt

All steps occur atomically in one transaction.

What is looping?

Looping is the DeFi-native way to create leverage:

- Deposit collateral

- Borrow against it

- Swap borrowed asset into more collateral

- Repeat

Because money markets require over-collateralization, each loop gives diminishing additional exposure.

Untangled Loop automates this with flash loans, so a user can enter a loop-like position instantly without manually repeating steps.

Open Positions

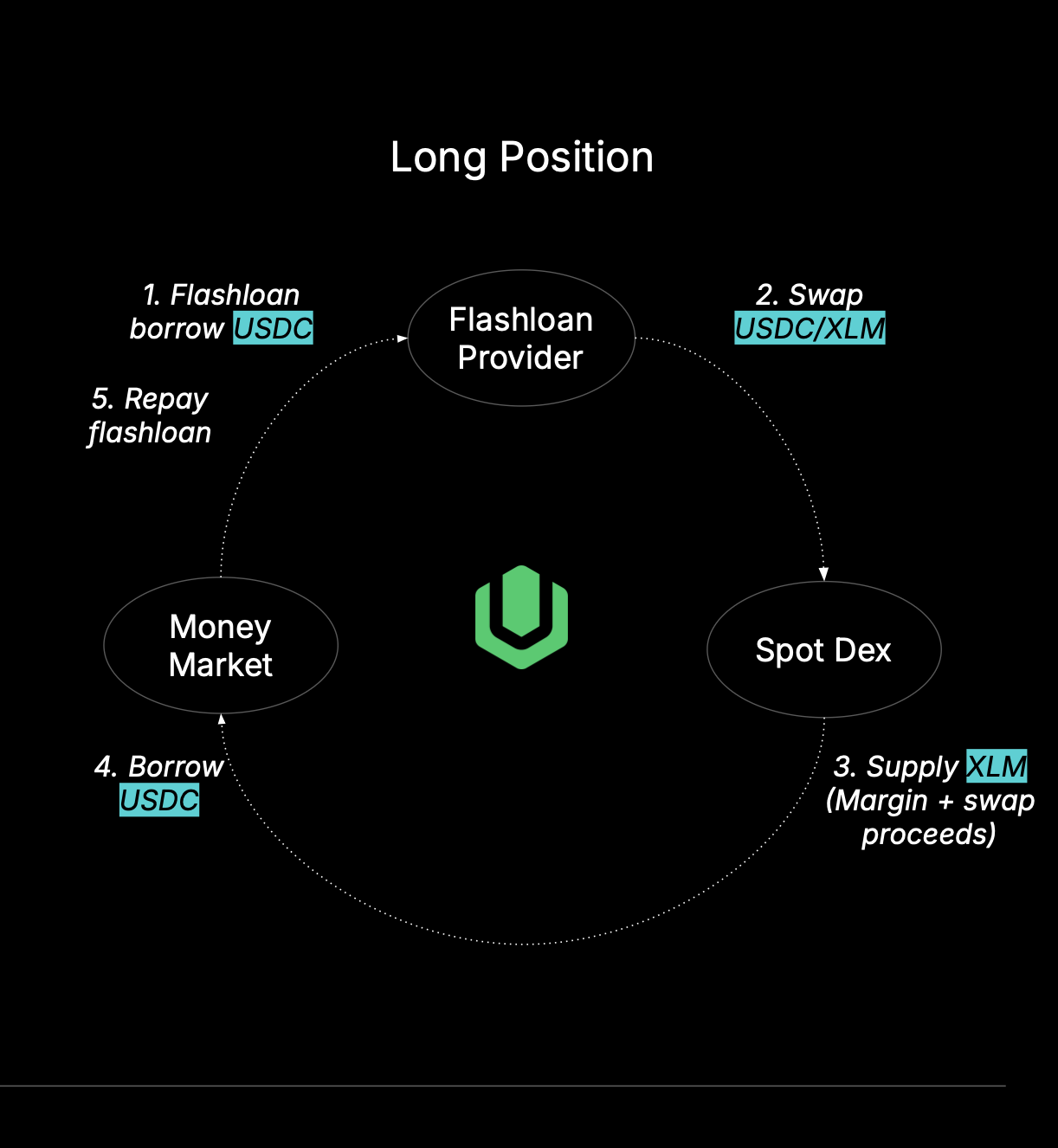

Open LONG Base (Base/Quote)

Example: XLM/USDC, going LONG XLM.

Goal: profit when XLM appreciates vs USDC.

Atomic flow:

- Flash loan Quote (USDC) from Blend

- Swap USDC → XLM via Aquarius (multi-hop supported)

- Supply XLM as collateral on Blend

- Borrow USDC on Blend

- Repay the flash loan (USDC)

Result

- Collateral: XLM

- Debt: USDC

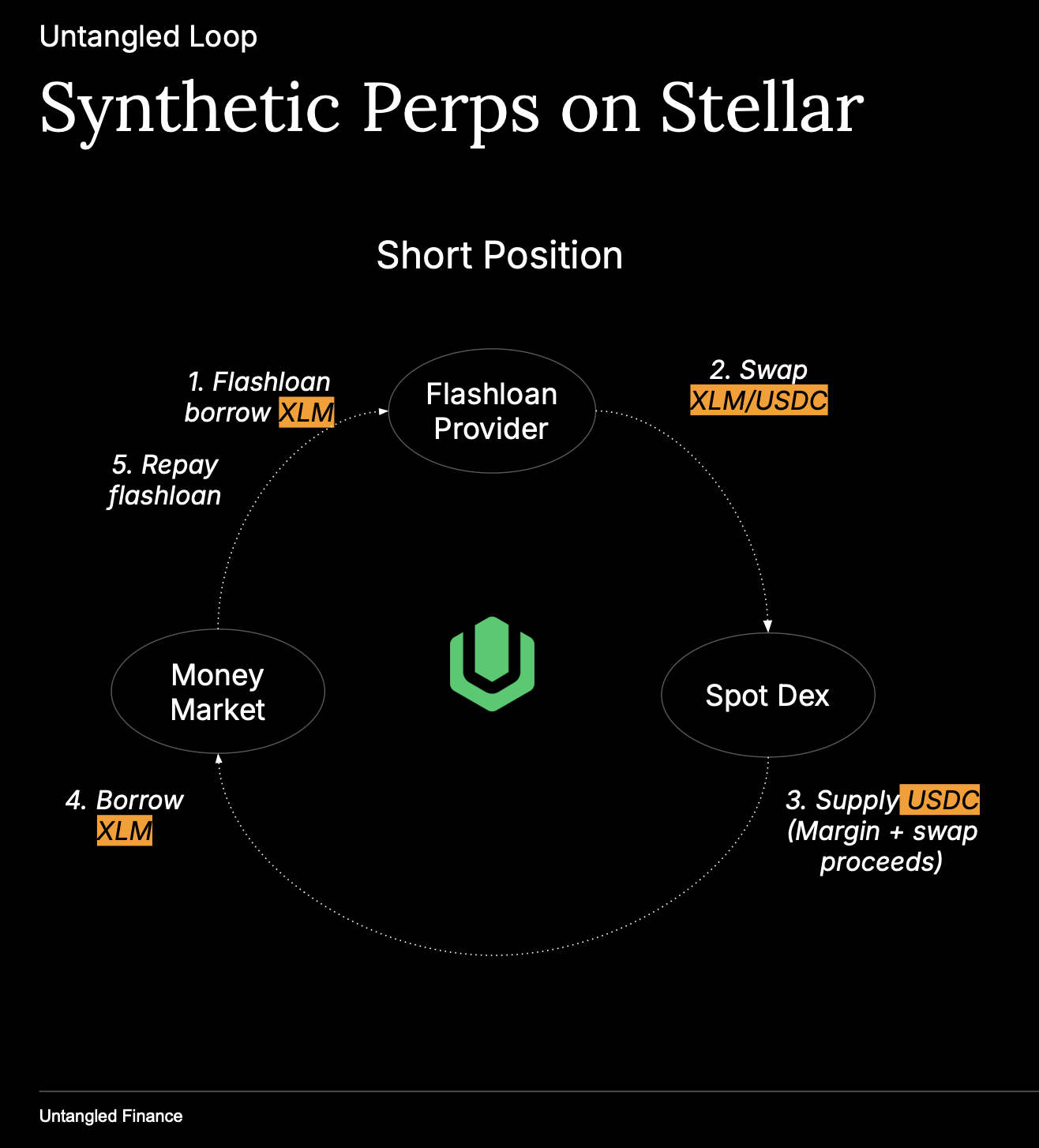

Open SHORT Base (Base/Quote)

Example: XLM/USDC, going SHORT XLM.

Goal: profit when XLM depreciates vs USDC.

Atomic flow:

- Flash loan Base (XLM) from Blend

- Swap XLM → USDC via Aquarius

- Supply USDC as collateral

- Borrow XLM

- Repay the flash loan (XLM)

Result

- Collateral: USDC

- Debt: XLM

Close / reduce positions

Closing reverses the open flow using a flash loan to ensure atomic settlement.

Liquidity & price impact

Untangled Loop positions are built on top of:

- spot liquidity for the swap leg (Aquarius pools)

- money market liquidity for borrow/supply (Blend)

You should always:

- set sensible slippage protection (min_* params)

- watch price impact on the swap

- understand that larger trades can move borrow/supply rates in the money market

Carry / “funding”

Instead of perp funding, Untangled Loop carry is driven by money-market rates:

- You may earn supply yield on the collateral leg

- You pay borrow cost on the debt leg

- The net is the position’s carry

This carry is not a guaranteed fixed rate; it evolves with money market utilisation.