Liquidations

Maintain lending market's health

Overview

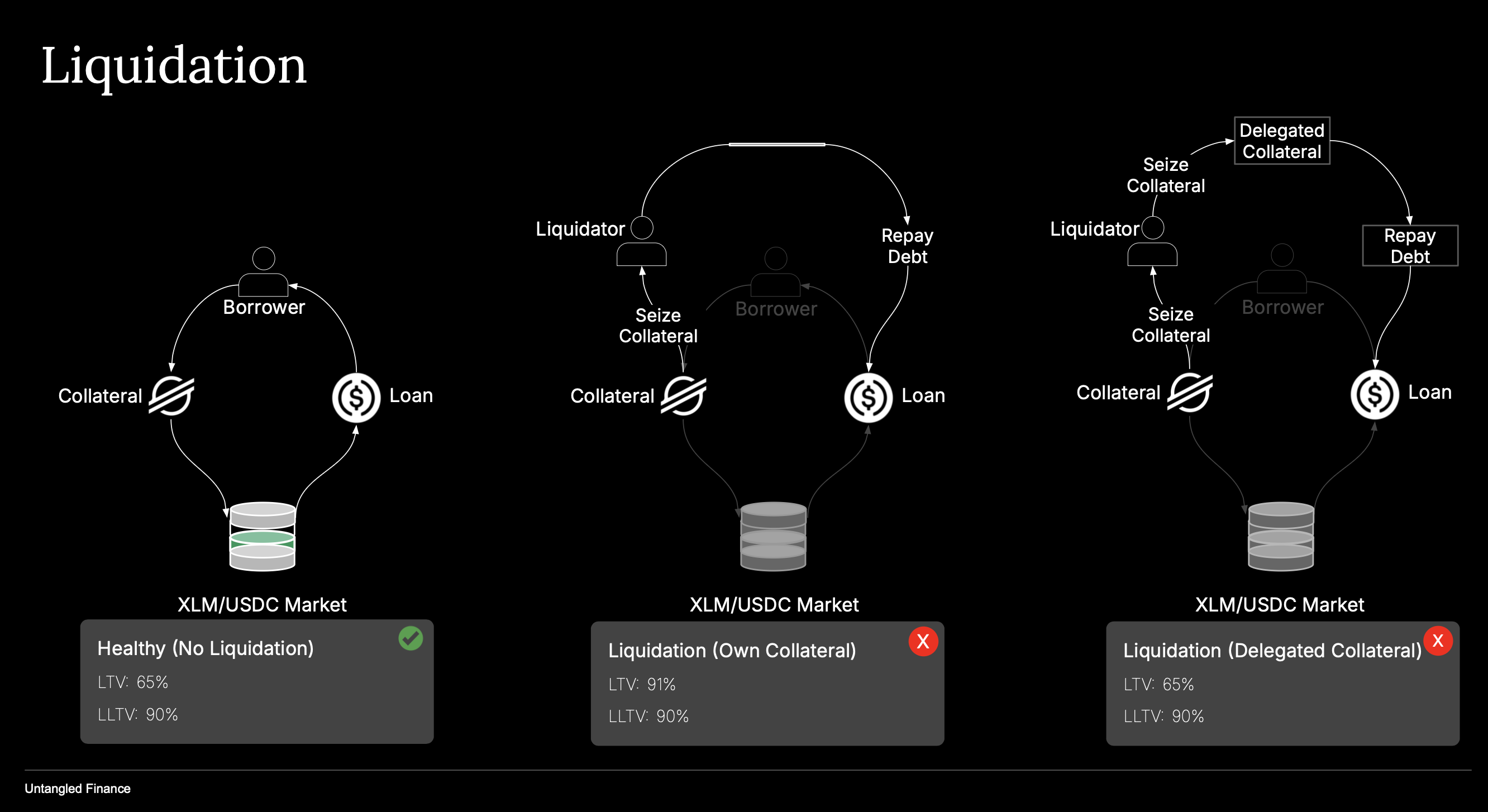

If a borrower’s position exceeds the Liquidation Loan-To-Value (LLTV) threshold, anyone can trigger liquidation.

The liquidation mechanism is deterministic, asset-based, and prioritizes fairness across both direct and delegated collateral.

Liquidation Conditions

A borrower becomes liquidatable when:

borrowed_value > collateral_value × (LLTV / 10_000)

where:

borrowed_value = borrowed_debt_tokens × debt_token_price

collateral_value = (posted_collateral + delegated_collateral) × oracle_price

Once breached, a portion of the debt may be repaid by a third-party liquidator in exchange for a discounted share of collateral.

Order of Collateral Seizure

Liquidation proceeds in a strict order to protect liquidity providers and preserve the integrity of delegated collateral:

- Borrower’s own collateral is seized first: The protocol transfers the seized collateral tokens directly from the borrower’s balance held in the Lending Market contract to the liquidator.

- Delegated collateral (if any) is used only if the borrower’s own collateral is insufficient to cover the repay amount plus liquidation bonus. The market pulls the shortfall amount from the borrower’s allocated collateral in the Collateral Vault.

- The Collateral Vault then updates its records and fee accruals to reflect the loss.

This creates a clear separation of responsibility:

- Borrowers lose their own assets first.

- Delegated collateral functions as a buffer.

This dual-layer order preserves isolation: losses from one borrower do not propagate beyond that borrower’s delegation agreements.

Partial Liquidation

Liquidation can be partial. A liquidator may choose to repay any amount up to the borrower’s available-to-liquidate value, computed as:

available_liquidation = principal_value − (1 − LLTV/10_000) × (principal_value − borrowed_value)

If the liquidator repays less than the full amount, the position remains open with reduced debt and reduced collateral.

Partial liquidation allows gradual deleveraging without full position closure and avoids excessive price impact in the underlying markets.

Liquidation Bonus

The liquidation bonus (bps) determines the incentive paid to liquidators. Liquidators receive collateral worth:

repay_amount × (1 + bonus_bps / 10_000)

Valued at the oracle price of the collateral asset.

This bonus compensates for transaction costs and risk of timing mismatches between repayment and collateral transfer.

Settlement and Accounting

- The repay amount is transferred from the liquidator to the Treasury (the market’s asset reserve).

- The corresponding debt tokens are burned, reducing total debt supply.

- The collateral seized (own + delegated, if needed) is transferred from the market (and/or Collateral Vault) to the liquidator.

- Storage is updated to reflect new borrower collateral and debt balances.

- If delegated collateral is seized, an event is emitted for the Collateral Vault to reconcile allocations and fees.

Key Parameters

| Parameter | Description |

|---|---|

| Liquidation Threshold (LLTV) | Determines when liquidation becomes possible. |

| Liquidation Bonus (bps) | Defines the incentive multiplier for liquidators. |

| Oracle | Provides the reference price for collateral valuation. |

| Collateral Vault (optional) | Source of delegated collateral if borrower’s own funds are insufficient. |

Summary

Liquidation in OctoLend is partial, prioritized, and deterministic:

- Partial: Only as much debt as needed is repaid each time.

- Prioritized: Borrower’s own collateral is liquidated before any delegated collateral.

- Deterministic: Valuation is fully oracle-driven, with transparent bonus and threshold parameters.

This design ensures that credit losses are contained within each market and allocation relationship, aligning incentives between borrowers, delegators, and liquidators.