Collateral Delegation

Decentralize credit underwriting

Overview

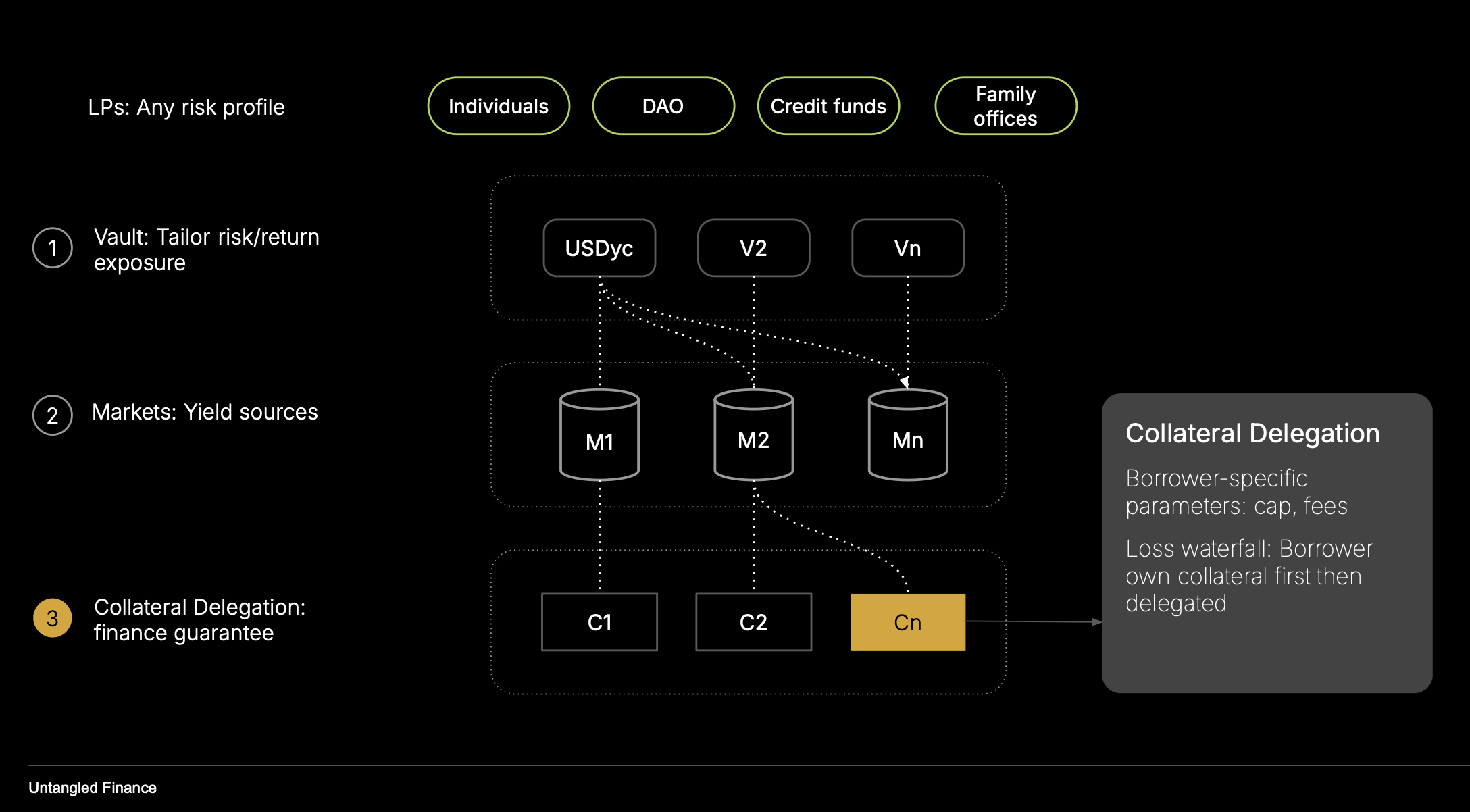

The Collateral Vault is the additional underwriting layer of OctoLend. It fills the collateral shortfall for delegated borrowers to borrow the desired amount of loan asset.

It holds collateral assets on-chain and allows vault curators to delegate portions of that collateral to trusted borrowers or credit facilities.

Delegated amounts can then be allocated into specific lending markets, creating a programmable, non-custodial form of credit enhancement without rehypothecating assets.

Purpose

As in traditional lending protocols, borrowers can post their own collateral to borrow. Additionally, collateral can be pooled by institutional providers and delegated to borrowers under controlled policies — enabling:

- Bootstrapping of real-world assets (RWAs) whose liquidity is still developing.

- Decentralized underwriting and first-loss participation.

- Configurable credit support that mirrors off-chain credit facilities.

Core Mechanism

The vault manages three layers of accounting:

| Layer | Description | Stored As |

|---|---|---|

| Free | Assets supplied by depositors. Issued as vault shares. | Vault::total_assets() |

| Delegated | Collateral amounts delegated to receivers (potential borrowers). | Delegation(Address) |

| Allocated | Delegated amounts currently committed to a specific borrower’s credit facility. | Allocation(Address, context_id) |

Delegations define who may borrow, while allocations define how much is currently in use. Both are strictly capped by the vault’s total assets.

Receiver Policies

Each receiver (borrower/delegatee) operates under a configurable policy that governs how much delegated collateral they can use.

- max_allocation_rate: Maximum ratio between allocated amount and the borrower’s posted collateral in the linked market.

- min_collateral: Minimum amount of borrower collateral required to activate delegation.

- delegation_fee_bps: Annualized fee rate charged on the allocated amount, accruing continuously over time.

These parameters ensure credit usage remains capital-efficient but risk-aware. They can be tailored per borrower to reflect different credit profiles or facility structures.

Delegation and Allocation Flow

1. Deposit

- Users deposit collateral (e.g., XLM, RWA) into the vault and receive vault shares.

- Deposited assets are routed to the vault’s treasury address for safekeeping.

2. Delegation

- A curator delegates part of the vault’s available collateral to a borrower (receiver).

- The vault checks remaining capacity using:

3. Allocation to Credit

- When the borrower draws credit from a linked market:

- A portion of their delegated collateral is allocated to that market.

- Policy limits ( and ) are enforced.

- Fees start accruing based on .

4. Deallocation / Liquidation

- As the borrower repays or their facility winds down, allocations are reduced or liquidated.

- Delegated capacity is released and becomes available again for new borrowers.

Fee Accrual

Delegation fees are calculated linearly over time according to:

Fees are tracked per allocation and aggregated at the vault level. They represent compensation for providing delegated, first-loss capital.

Integration with Lending Markets

Delegation is borrower-specific. Borrowers decide which market to use their delegation for.

- A Market can only have one Collateral Vault,

- but one Collateral Vault can delegate to multiple borrowers across many markets.

When collateral is allocated or deallocated:

- The vault adjusts its token allowance to that market accordingly.

- The lending market can only pull collateral up to the current allocated ceiling.

This ensures composability with lending protocols while maintaining strict custody boundaries.

Risk Controls

The Collateral Vault enforces multiple layers of safety:

- Isolated: Each vault is self-contained; failures cannot propagate across markets.

- Policy enforcement: Borrowers cannot exceed configured limits or bypass checks.

- No rehypothecation: Collateral remains escrowed within the vault contract.

- Fee transparency: All fees and allocations are tracked on-chain and auditable in real time.

- Epoch-based liquidity: Asynchronous withdrawals prevent sudden liquidity drains.

Example Use Case

An RWA issuer wants to bootstrap liquidity for a new tokenized treasury fund:

- Institutional providers deposit XLM into the Collateral Vault.

- The RWA issuer receives a delegation capped at 50% of their on-chain collateral.

- The issuer allocates part of that delegation to open a credit line in a linked OctoLend market.

- Delegation fees accrue to providers, compensating them for taking first-loss exposure.

- When the loan matures, allocations are released and the delegation resets.

Summary

The Collateral Vault transforms collateral into a programmable financial guarantee layer.

It gives curators and institutions the ability to distribute credit capacity securely and transparently while maintaining strict isolation and capital efficiency.

By decoupling collateral provision from borrowing, OctoLend enables on-chain credit markets that operate closer to real-world finance in a predictable, auditable, and composable manner.