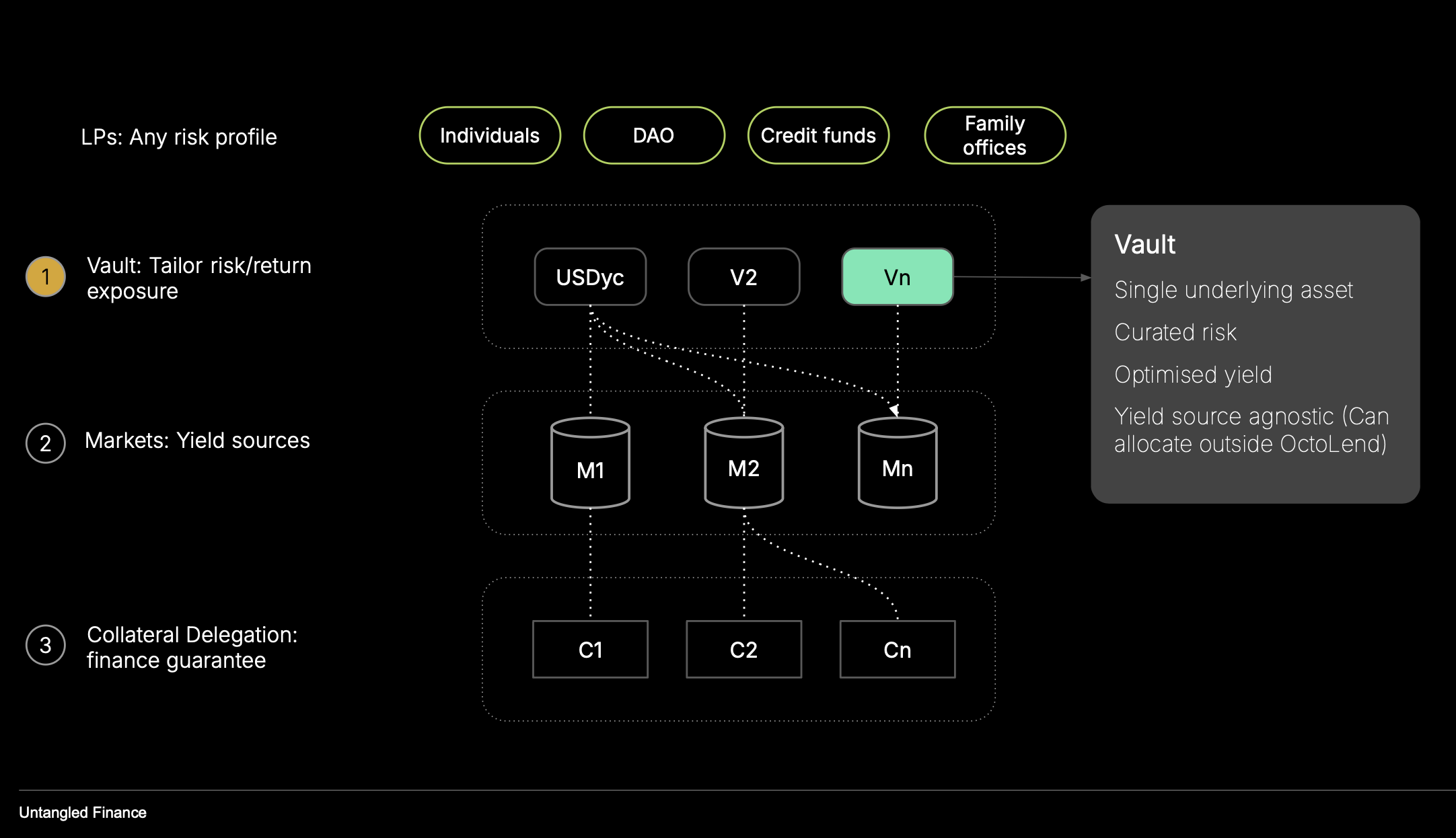

Earn Vault

Curated entry point to OctoLend

What is Earn Vault

A Earn Vault (Vault V2) on Stellar holds one base asset (e.g. USDC) and issues a share token representing proportional ownership of its total value.

Curators deploy and manage these vaults via the Untangled Curator App, allocating capital across OctoLend markets and integrated protocols.

All vaults are immutable, transparent, and managed via multisig or MPC treasuries (e.g. LOBSTR Vault or Fireblocks MPC).

Please note the following focus on Vault V2. Vault V1 also works with OctoLend markets and you can find out more in the Curate section.

Vault V2 leverages OpenZeppelin Stellar Contracts for Fungible Vaults with a minor modification being an external address as the treasury for curation purposes.

At a glance

- Permissionless Anyone can deploy and configure a Vault V2 instance.

- Non-custodial Assets live in the curator-controlled Treasury, not the contract.

- Deterministic math On-chain mint/redeem with fixed-point arithmetic and virtual offsets.

- Composable SAC shares integrate across Stellar DeFi.

- Immutable No upgradability; predictable long-term behaviour.

- Integration-ready Ideal as the accounting backbone for OctoLend, RWAs, and automated strategies.

Key properties

-

Treasury-separated custody Underlying assets are held in a designated Treasury account rather than the vault contract, improving composability with multisig/MPC governance.

-

Deterministic conversion math Shares/asset ratios are computed on-chain using fixed-point arithmetic with virtual offsets, stabilizing behaviour at low liquidity.

-

ERC-4626-like model for Stellar Implements deposit, mint, withdraw, redeem, and preview functions in a standardized, integration-friendly interface.

-

Composable SAC shares Vault shares are Stellar Asset Contract (SAC) tokens, compatible with Stellar wallets, AMMs, and DeFi protocols.

-

Immutable behaviour Conversion logic, custody model, and metadata are fixed at initialization.

-

Non-custodial Untangled never takes custody. Treasury is controlled by the curator or strategy owner (e.g., LOBSTR multisig, Fireblocks MPC).

How it works

Curation & strategy

Vault V2 itself does not perform strategy or valuation. Curators may choose to use it as the base tokenized layer for higher-level systems (e.g., OctoLend Lending Markets or RWA strategies). Also with treasury being an external address curators can also leverage its curation capabilities, just like in V1.

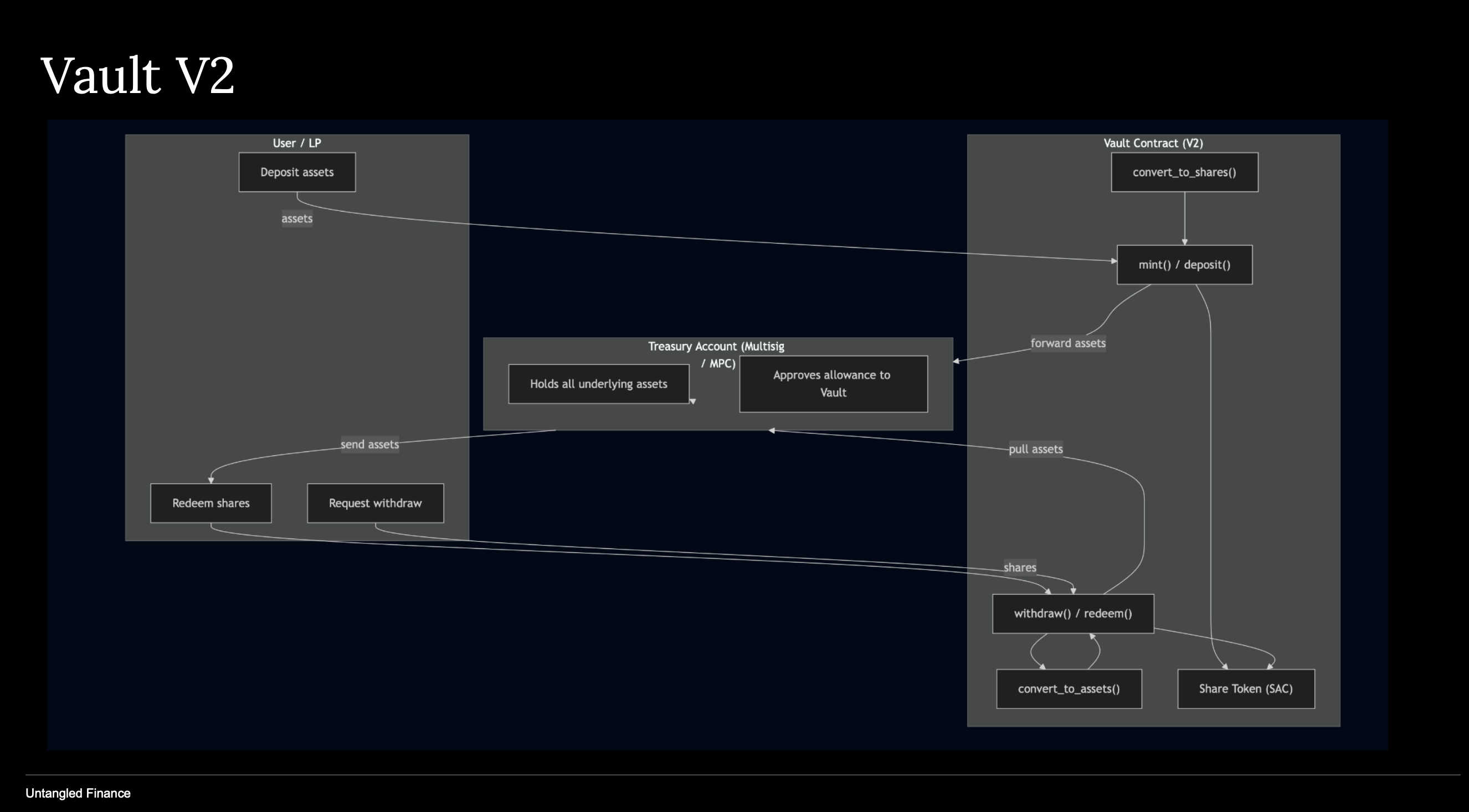

Deposits & Minting

Users deposit the underlying asset to mint shares:

- Vault calculates shares using convert_to_shares().

- Underlying tokens are transferred to the Treasury account.

- Vault mints SAC share tokens to the receiver.

Withdrawals & Redemption

Users burn shares to receive underlying assets:

- Vault computes required assets using convert_to_assets().

- Vault pulls tokens from the Treasury using transfer_from (Treasury must provide allowance).

- Shares are burned and assets are delivered to the user.

Conversion Logic

Conversion uses:

- Virtual total supply: totalSupply + 10^offset

- Virtual total assets: totalAssets + 1 These eliminate division-by-zero and ensure stable ratios from genesis to high-TVL operation. Rounding uses floor for predictable behaviour.

Total Assets

total_assets() returns the Treasury’s balance of the underlying token.

Roles

Treasury

The multisig or MPC account that holds all underlying assets. Must grant allowance to enable withdrawals/redemptions.

Vault Contract

Issues/burns shares, computes conversions, orchestrates transfers between itself and the Treasury.

Operator

Authorizes actions (deposit/mint/withdraw/redeem).