Use Cases

Vault supports a wide range of use cases.

Here are 3 of them:

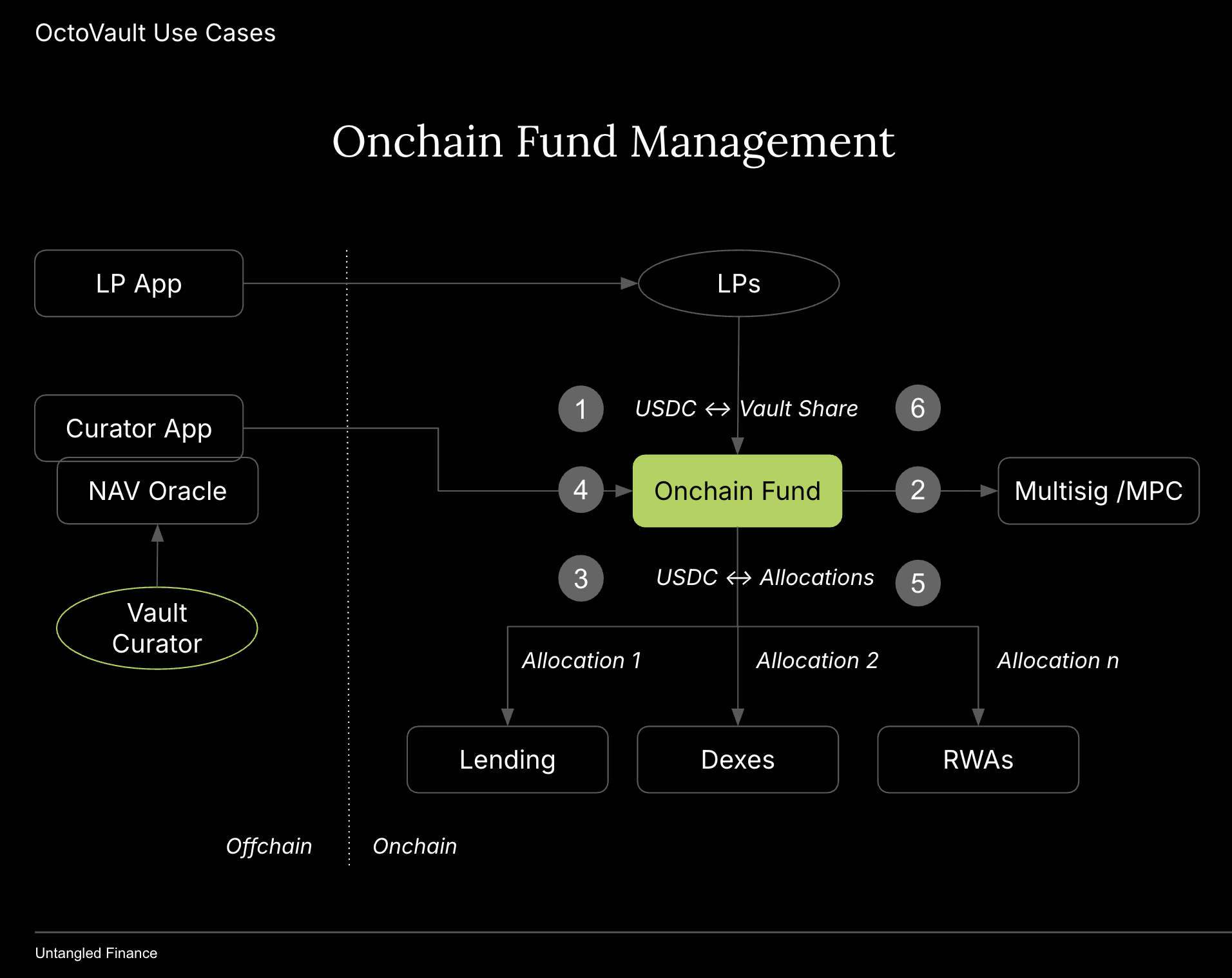

Onchain Fund Management

Strategy flow:

- LPs deposit USDC into Onchain Fund Vault in exchange for Vault Share via LP App

- Funds are stored in a Stellar multisig account controlled with m of n signature scheme on LOBSTR Wallet and Vault

- Vault Curator allocates to top stablecoin yield protocols on Stellar:

- OctoLend (upcoming fixed rate lending market)

- Blend (money market)

- Aquarius AMMs (DEX)

- DeFiHub

- StellarX AMMs

- Stellar Term AMMs

- SoroSwap AMMs

- Curator tracks vault share price and portfolio NAV (Oracle) via Curator App

- Allocations are continuously monitored and rebalanced across protocols

- LPs request withdrawals (asynchronous). After the epoch ends, the Curator processes withdrawal requests.

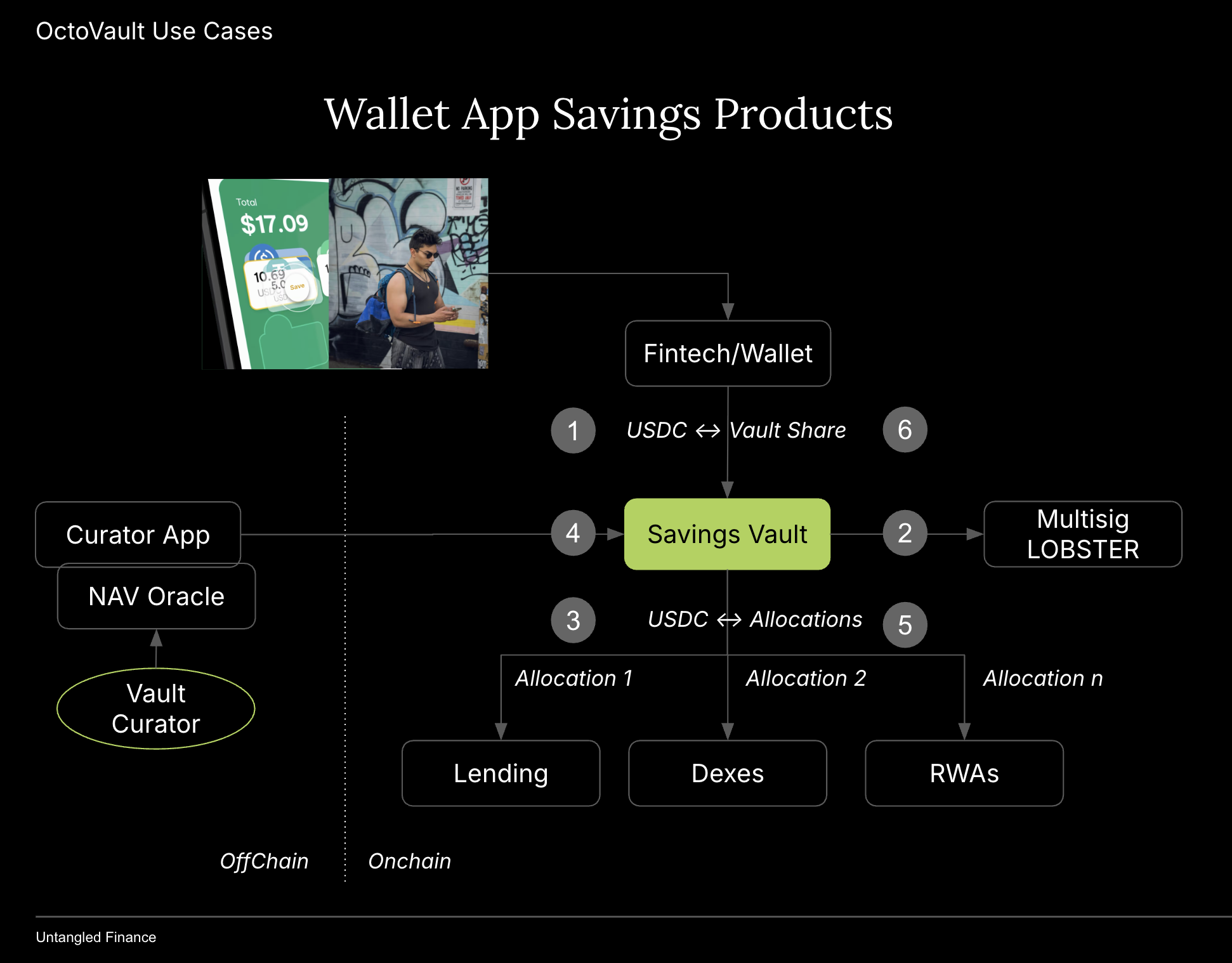

Savings

Strategy flow:

- On fintech or wallet apps, users click “Save” which moves their USDC into a Savings Vault

- This can be done onchain or offchain (custodial)

- Funds are stored in a Stellar multisig account controlled with m of n signature scheme on LOBSTR Wallet and Vault

- Vault Curator (fintech app company) allocates to top stablecoin yield protocols on Stellar:

- OctoLend (upcoming fixed rate lending market)

- Blend (money market)

- Aquarius AMMs (DEX)

- DeFiHub

- StellarX AMMs (native)

- Stellar Term AMMs (native)

- SoroSwap AMMs

- Curator tracks vault share price and portfolio NAV (Oracle) via Curator App

- Allocations are continuously monitored and rebalanced across protocols

- Users request withdrawals (asynchronous). After the epoch ends, the Curator processes withdrawal requests.

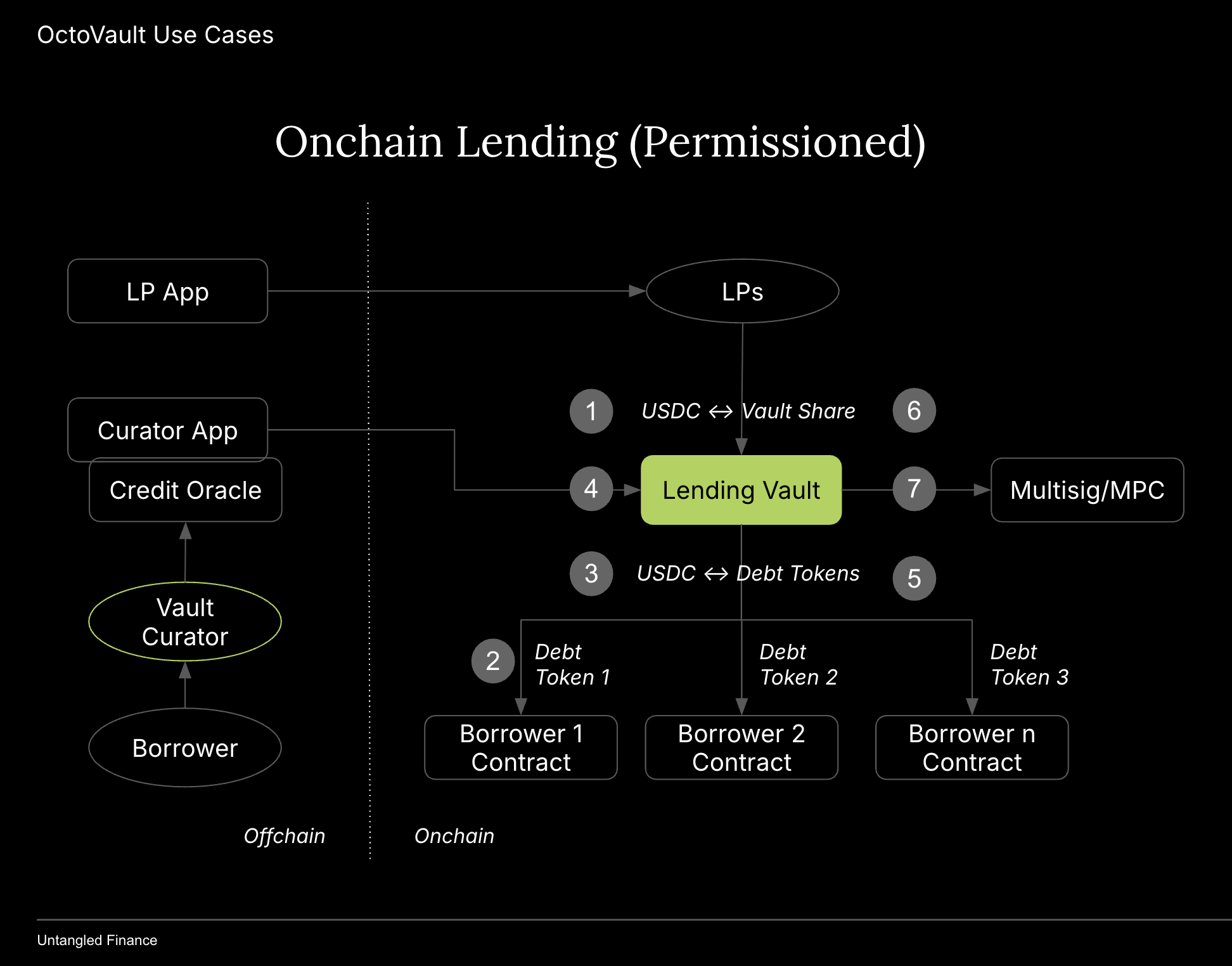

Lending

Strategy flow:

- LPs (KYC’ed and whitelisted) deposit USDC into Lending Vault in exchange for Vault Share via LP App

- Curator approves Borrowers offchain then deploys borrower contracts (Accounts) onchain with Curator App

- Drawdown requests approved offchain → Vault Curator disburses funds to borrower accounts in exchange for the Borrower’s Debt Tokens (loan tokenization)

- Curator tracks loans offchain and updates Debt Token prices (Oracle) via Curator App

- Borrowers repay by depositing funds to Borrower Accounts → Curator collects payment → Equivalent Debt Token amount is burnt

- LPs request withdrawals (asynchronous). After the epoch ends, the Curator processes withdrawal requests.

- Funds are held on multisig or MPC wallet / curating solutions.

- Idle funds can be used to earn extra yield from any DeFi yield sources on Stellar (including Untangled products).