Architecture

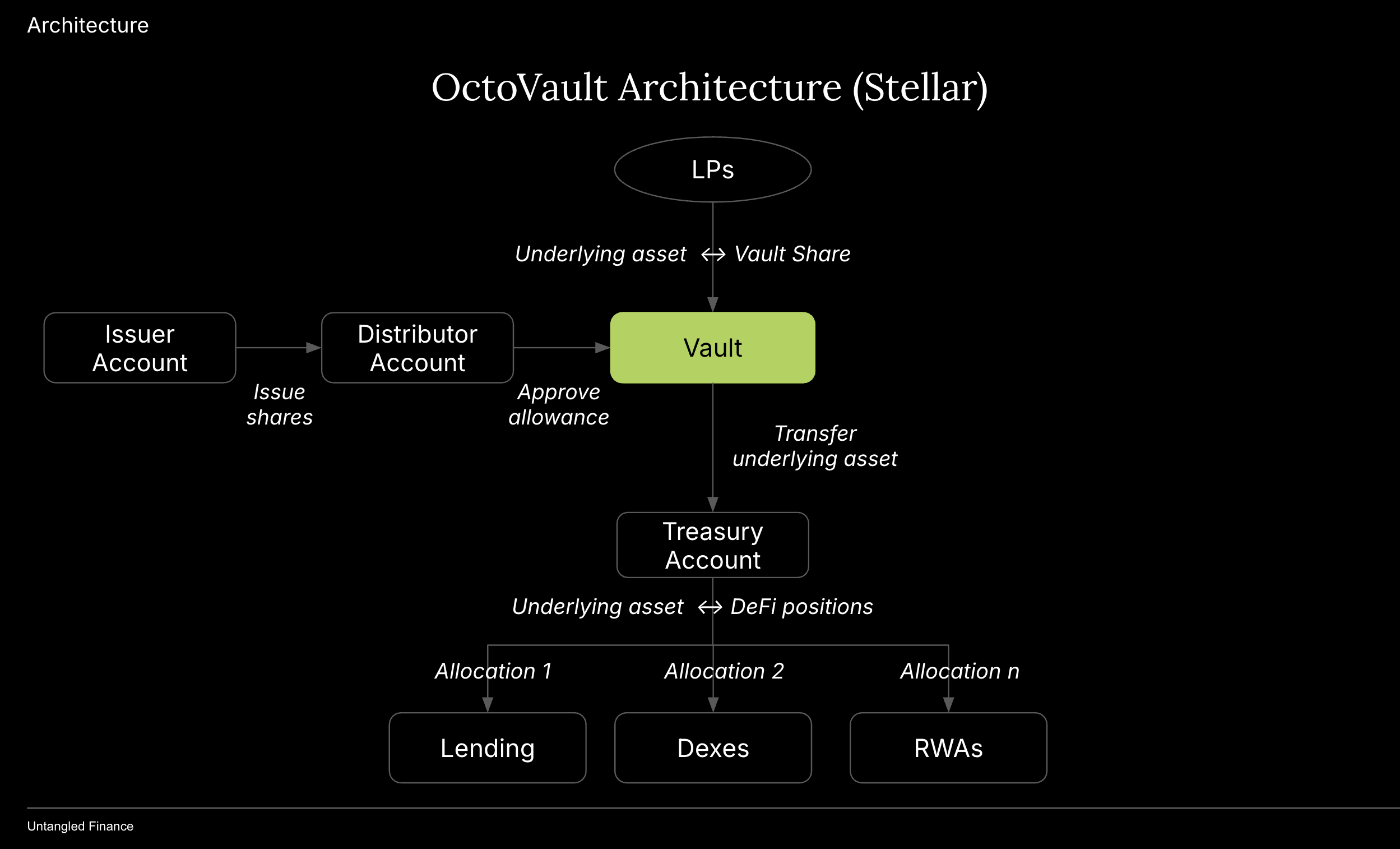

Provides an overview of Vault V1 design.

Please note the rest of this section deals with Vault V1. Vault V2, once audited, will operate alongside Vault V1 and target OctoLend use cases.

Vault architecture is made of a vault contract, a share token and a curating solution. Vault can support all major curating solutions on Stellar:

- Multisig wallet with LOBSTR Vault

- MPC Wallet with Fireblocks

FAQ

What is OctoVault?

A Vault on Stellar is made of:

- 1 vault smart contract;

- 1 vault share token

- A curation solution (i.e. Treasury Account) i.e LOBSTR Multisig or MPC represented by an address on the Vault contract

What do Liquidity Providers (LPs/users) get after depositing into an OctoVault?

In exchange for their assets, users receive a share of the vault, in the form of a SAC Token.

Is the vault share composable with the rest of DeFi on Stellar?

Yes, all shares are SAC tokens.

Can the curating solution/treasury address be updated?

No, it can't be updated.

What kind of strategy can Vault support?

OctoVault support a wide range of strategies: You can refer to 3 use cases here Onchain fund management, Savings, Lending (Permissioned)

Does the protocol charge fees?

Untangled has the capacity to activate a fee switch at the protocol and vault level. Those are capped at 30% of the fees of the curator or 10% of the earnings for LPs, whichever is higher.

Can an Vault support a cross-chain strategy?

It depends on the curation solution you chose and its flexibility. For example, with a MPC Fireblocks you could bridge funds and assets cross-chain.

Security

How decentralized is the Protocol?

OctoVaults are not-upgradeable.

Is the protocol opensourced?

Yes, all contracts are open sourced here.

Has Untangled Vault been audited?

Yes, it has been audited by Veridise; find out more in the security page.