Optional Treasury Solution

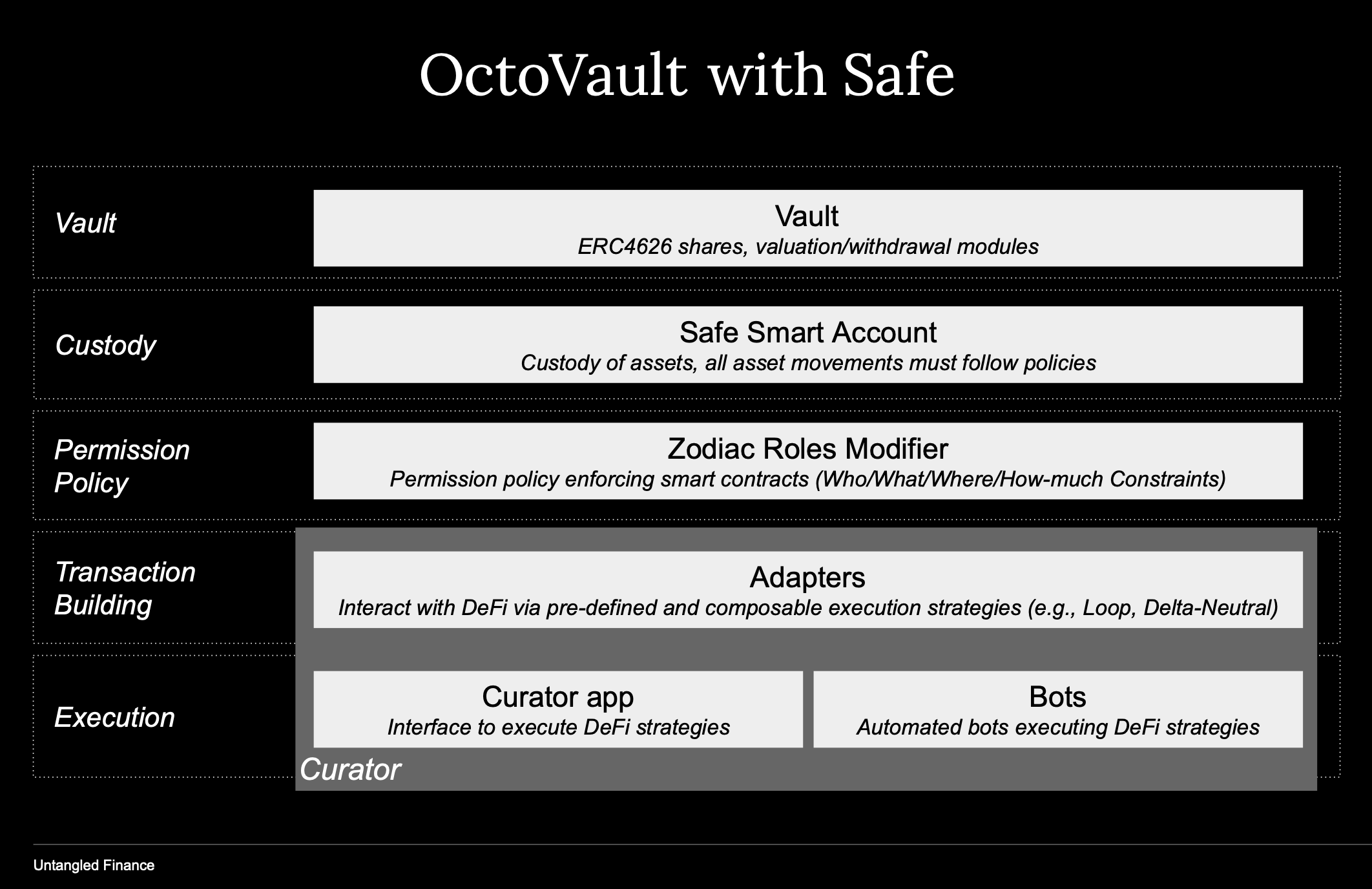

Integrate Safe into OctoVault

Overview

While every Vault and Market in OctoVault can self-custody assets within their contracts by default, curators may choose to use an external Treasury for fund custody and execution.

A common option is Safe, a widely adopted multisignature wallet and DAO treasury platform. Integrating a Vault with Safe (later, MPC wallets) enables institution-grade fund management — combining OctoVault’s on-chain accounting and structured yield logic with Safe’s governance, permissions, and cross-chain control.

Safe as a Curation Solution

Safe is smart-contract wallet infrastructure for DAOs and institutions. It offers:

- Treasury tools: Safe powers many of Web3’s leading DAOs and protocols.

- Zodiac Role Extensions: Fine-grained, programmable role and permission management.

- Multichain support: Consistent wallet addresses across 15+ EVM chains.

- Account abstraction: Enabling seamless onboarding and cross-chain execution.

These capabilities allow an OctoVault to access opportunities across EVM ecosystems while preserving operational control.

Safe manages and deploys capital — not investor onboarding or share issuance. The tokenised vault continues to handle deposits, share accounting, and redemptions, while Safe serves as the execution and custody layer.

How It Works

Vault Deployment with Safe

- When a new Vault or Market is deployed, a dedicated Safe can be issued as its Treasury wallet.

- The Safe may be deployed on multiple chains using the same address, ensuring unified governance and cross-chain execution.

- The Vault contract maintains accounting logic — ERC-4626 shares, valuation, and timelocked governance — while the Safe manages actual asset movements.

Role-Based Control via Zodiac Extensions

To govern treasury operations, the Vault Admin launches a Zodiac Roles contract attached to the Safe. Within this setup:

- A Curator Role is granted to a specific Safe instance, referred to as the Curator Safe.

- Using Zodiac’s permission framework, the Vault defines:

- Allowed protocols (e.g., Morpho, GMX, Euler)

- Allowed functions and parameters (e.g.,

supply(),withdraw(),rebalance()) - Transaction limits and timelock rules

These roles are verifiable on-chain and prevent the Curator from taking unapproved actions, such as direct withdrawals. Permissions are consistent across all Vault Safes, including multichain deployments.

Delegation and Automation

The Curator Safe can delegate granular permissions to:

- Externally Owned Accounts (EOAs) controlled by human operators, or

- AI or algorithmic agents responsible for rebalancing or executing predefined strategies.

This allows the Vault to respond quickly to market changes — executing trades, rebalances, or harvests automatically — while remaining fully compliant with pre-approved permissions.

User Interaction and Custody

- Users, such as LPs, client protocols, or DAO treasuries, deposit into the Vault contract and receive vault shares (ERC-4626).

- Assets are then held in the Vault Safe, which is non-custodial and transparent.

- All movements from the Safe must follow the permissions encoded in Zodiac Roles.

This separation between fundraising (Vault) and fund management (Safe) mirrors traditional fund structures with clear operational segregation.

Cross-Chain Execution

Safe’s multichain account abstraction enables a single Safe address to operate seamlessly across EVM networks. With the correct permissions:

- The Curator Safe can execute cross-chain transactions to invest, redeem, or harvest from markets on other networks.

- All actions remain governed by the same role configuration and authorisation logic, ensuring consistent risk controls across chains.

This allows vaults unified access to the entire EVM ecosystem while maintaining timelocked governance, auditability, and institutional-grade security.

Summary

By integrating Safe as an optional Treasury solution, OctoVault curators gain:

- A secure, modular, and auditable execution layer

- Fine-grained, programmable control through Zodiac Role Extensions

- Cross-chain execution under consistent permissions

- The ability to delegate Safe-limited permissions to humans or AI agents

- Full transparency and on-chain verifiability of all treasury actions

In this model:

- The Vault manages investor deposits, shares, valuation, and governance.

- The Safe executes transactions, holds assets, and ensures operational safety.