What is OctoVault?

Overview

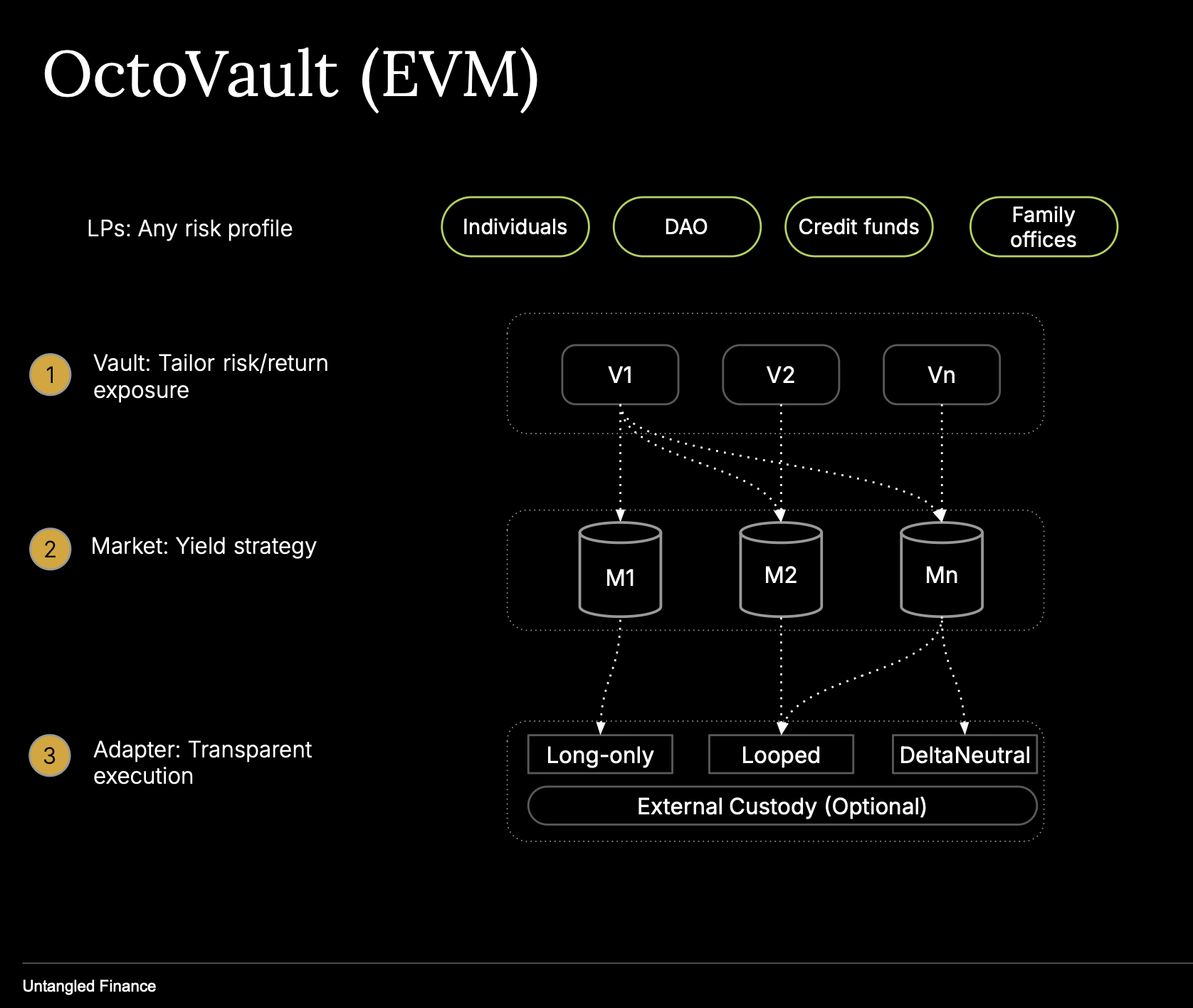

Most vault infrastructure in DeFi today focuses on aggregating existing yield sources, routing user deposits into lending markets, liquidity pools, or staking positions in a long-only manner. Leveraged strategies such as looped lending, basis trading, or delta-neutral vaults are usually confined within a single protocol. While these products simplify access to yield, it is difficult for curators to build structured strategies that combine multiple protocols or take advantage of leverage, hedging, and market inefficiencies.

OctoVault solves this by extending vault infrastructure beyond passive aggregation, providing a programmable, modular framework for building structured yield products in a simple, transparent, and predictable way.

Built on top of perpetual DEXs, lending protocols, and RWA or staking yield sources, OctoVault allows curators to design yield vaults that dynamically combine:

- Leverage (through lending and borrowing flows)

- Hedging (through perps or delta-neutral positions)

- Stable income (through RWA or long-only yield sources)

Inspired by the isolated risk architecture pioneered by Morpho, OctoVault separates responsibilities into two composable layers:

- Vault (MetaVault): a multi-strategy vault that allocates across several Market vaults, managing target weights, rebalancing, and governance.

- Market Vault: a single-strategy vault that interacts directly with external DeFi protocols through modular, whitelisted Adapters.

This layered design allows any curator - from institutional asset managers to on-chain strategy builders - to construct transparent, secure, and composable structured yield products.

Key Features

| Feature | Description |

|---|---|

| Permissionless | Anyone can deploy vaults and define strategies. |

| Isolated risk | Each Market vault manages its own assets and adapters. |

| Multi-strategy | Combine lending, RWA, and delta-neutral markets. |

| Transparency | Valuation module tracks NAV and share price on-chain. |

| Composability | Vault shares are ERC-4626 compatible for integrations. |

| Non-custodial | Assets always stay in the vault contract or optional curation wallet such as Safe. |

| Role separation | Clear operational boundaries: Admin setup and security; Curator runs strategies; Guardian provides oversight. |

| Timelock | Changes are queued and visible before taking effect. Guardian can cancel any pending change. |

FAQ

What do depositors receive?

When someone deposits an asset (e.g., USDC), the vault mints a corresponding number of ERC-4626 shares. These shares represent a proportional claim on the vault’s total assets and grow in value as the underlying portfolio earns yield.

Are vaults composable?

Yes. Vault shares follow the ERC-20 and ERC-4626 standards, so they can be traded, used as collateral, or integrated into aggregators and DeFi dashboards.

How are assets safeguarded?

Assets are always held inside the vault contract or its designated treasury. If a Hook is set, it manages the underlying portfolio; otherwise, the vault keeps or moves assets to a specified treasury address.

Who can change vault parameters?

- Admin: can set Hook, change Guardian/Curator, transfer admin rights.

- Curator/Admin: can stage changes to cap, timelock, or fee.

- Guardian: can veto any staged change before it’s accepted. All changes respect the global timelock delay for transparency.

How is portfolio value tracked?

If a Hook is connected, the vault calls hook.portfolioValue() to fetch the latest NAV.

Otherwise, the vault relies on its own ERC-4626 accounting (the asset balance it holds).

Are withdrawals immediate or batched?

Basedvaults support instant withdrawals. For controlled liquidity or redemption schedules, curators can enable a WithdrawModule, where requests are queued, settled per epoch, and claimed later.

Open & Permissionless Deployment

Need help? Contact our team via Telegram.