Future development - Synthetic Stake Token

Ethereum blockchain has just one single stake token - ETH - but a network on Symbiotic has to deal with multiple delegated collaterals, making it complex for optimisation. This vault will change that. Untangled Credio x OETH Vault brings risk-adjusted restaking yield to OETH deposits with a novel mechanism to abstract all collateral delegations to a network into a single token - Synthetic Stake Token - enabling new opportunities for networks and stakers to optimize risk/reward.

Current implementation requires networks to deal with fragmented collaterals, making it complex to optimise cost/benefit

-

Complexity: Networks and operators have to deal with many collateral tokens which change at every epoch.

-

Collateral Variability: Tokens exhibit diverse risk profiles (e.g., price volatility, staking variance, increasing cascade risk and threatening network stability.

-

Reward: Fixed or arbitrarily set reward rates many fail to reflect token-specific risks or network demand, leading to inefficiencies.

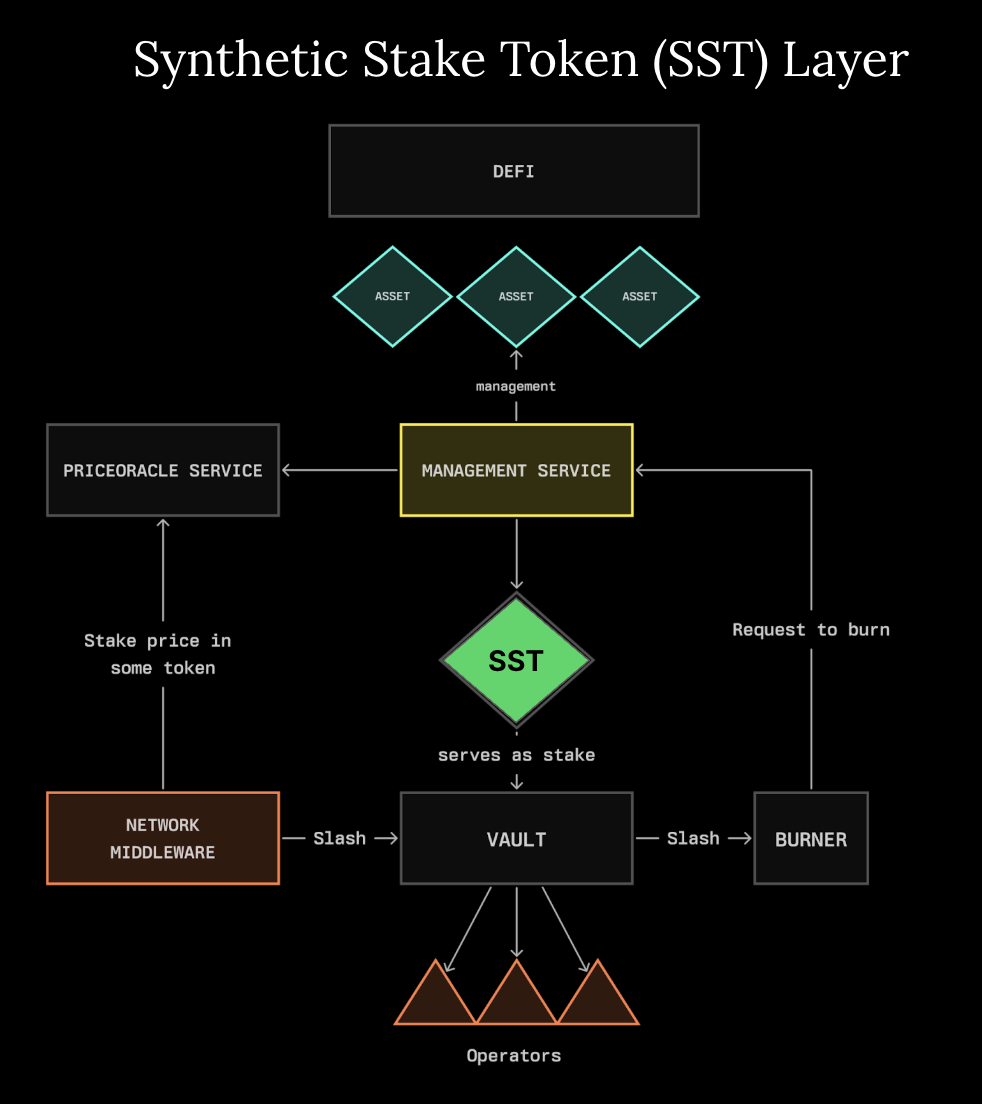

We propose Synthetic Stake Token (SST) to abstract all collateral delegations into a single token.

-

Aggregates delegations into one SST per network.

-

SST represents a share of total delegation.

-

Enables dynamic rebalancing and a unified interface.

How it works

-

Operators stake into networks and receive SST, representing their share of the network’s total delegated stakes.

-

All collaterals are converted to their dollar value. This allows for fair valuation of operators' stakes, regardless of the asset type they are staking.

-

Staking contracts must be connected to an oracle to quote the real-time price of each collateral asset.

Untangled is working with Symbiotic to implement SST layer.