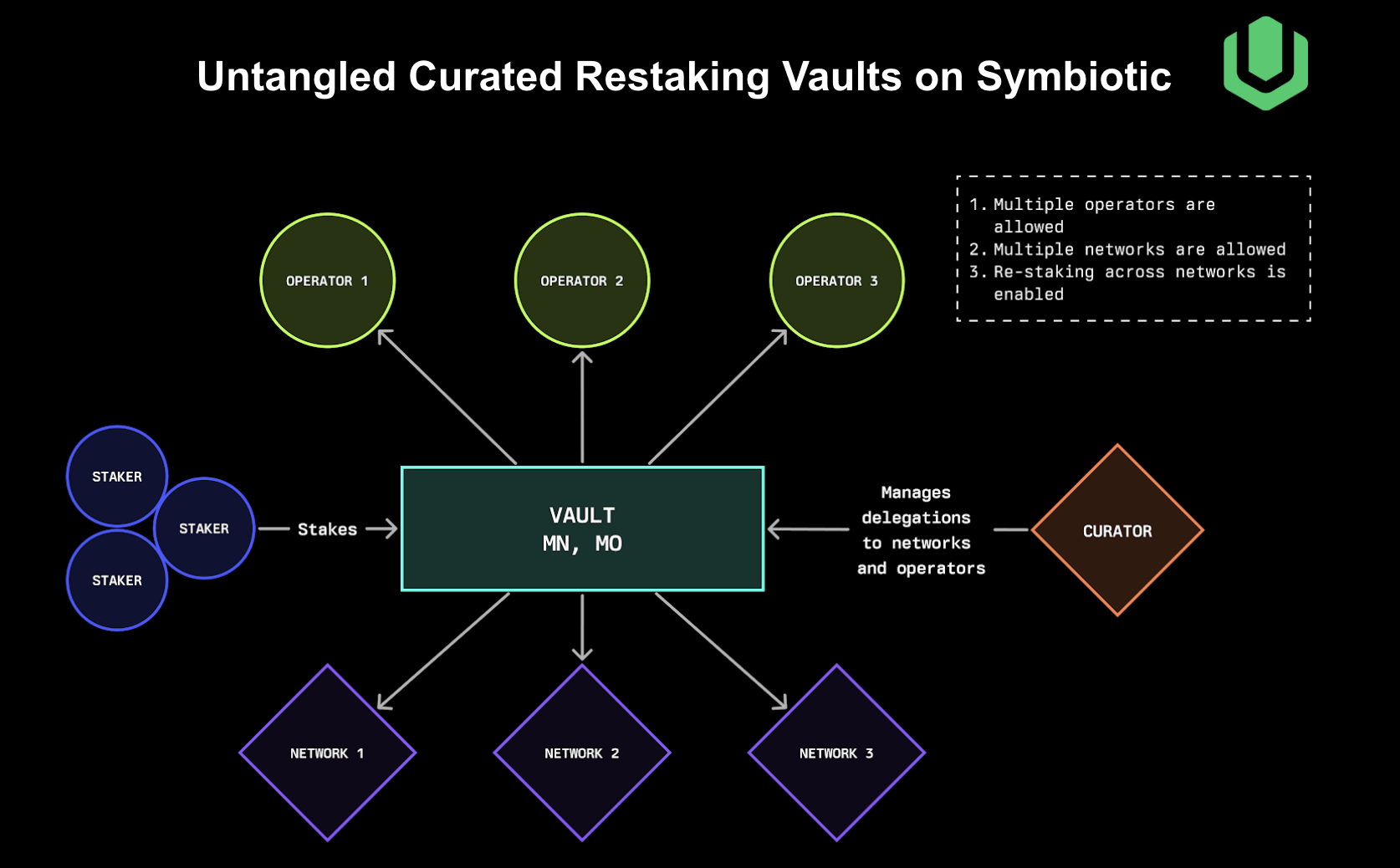

Restaking Vault Strategy

The vault targets high-yield opportunities, including “slashable” networks that offer higher returns but risk collateral loss, and safer, non-slashable networks with lower yields. Key objectives include:

-

Diversifying across networks and operators to spread risk.

-

Capping exposure to high-risk networks to limit worst-case losses.

-

Maximizing risk-free yields from non-slashable networks.

-

Monitoring on-chain (e.g., validator uptime, slashing events) and off-chain signals for real-time adjustments.

Delegation Target Selection

The vault selects networks using a rigorous framework:

-

Technical Risk Assessment: Evaluates network smart contracts, slashing mechanics, and audits to score software risk, incorporating external analyses and Credio’s risk oracle.

-

On-Chain Metrics: Tracks validator uptime, missed blocks, slashing history, and reward rates. Networks with strong performance and sustainable yields are prioritized.

-

Off-Chain Signals: Uses risk models from Credio, assessing governance, communication, and community trust. Networks with poor governance (e.g., centralized control) are avoided.

-

Yield Potential: Prioritizes high-APR networks with acceptable risk. Non-slashable networks (e.g., Radius, Ditto, Kalypso) are fully allocated for safe yield, while slashable networks (e.g., Primev, Hyperlane) start with small, conservative stakes. OETH’s yield-bearing nature and liquidity make it ideal collateral, boosting overall APY by combining ETH staking returns with Symbiotic rewards.

Dynamic Reallocation

The vault adjusts OETH allocations in real-time using:

-

Yield Tracking: Shifts stake to higher-yield networks if risk is acceptable, or away from underperforming ones.

-

Slashing Risk Signals: Automatically reduces exposure via a “delegator hook” if slashing occurs or validators show issues (e.g., downtime).

-

Periodic Rebalancing: Weekly resets to target allocations based on yield and risk updates.

-

Allocation Caps: Limits slashable network exposure (e.g., 20% max per risky network) to prevent over-concentration.

Rebalancing Triggers

-

Validator Downtime: Reduce stake if uptime drops.

-

Slashing Event: Withdraw stake immediately.

-

Yield Spike/Drop: Adjust allocations to capture or avoid opportunities.

-

Risk Downgrade: Scale back if a network’s risk score worsens.

-

New Network: Trial small stakes in vetted networks.

Risk Management

To mitigate slashing:

-

Diversification: Spreads OETH across multiple networks and 3–5 reputable operators.

-

Slashing Caps: Sets maximum loss per network (e.g., 5% of vault).

-

Monitoring: Tracks on-chain data and off-chain signals (e.g., governance changes) with alerts for quick action.

-

Risk Scoring: Excludes high-risk networks; limits stake to riskier ones.

-

Simulations: Stress-tests allocations to minimize worst-case losses.

No slashing has occurred on Symbiotic mainnet, but the vault is designed to prevent and respond to such events.

Conclusion

The Untangled Credio OETH vault balances high yields with disciplined risk management. Key steps include:

-

Launch Mix: Maximize non-slashable networks; allocate small stakes to vetted slashable networks (e.g., Primev, Hyperlane).

-

Operators: Onboard multiple high-quality operators with slashing limits.

-

Safeguards: Enable delegator hooks, set slashing caps, and deploy real-time monitoring.

-

Dynamic Tuning: Test and refine rebalancing logic; adjust caps as performance data emerges.

-

Transparency: Share weekly reports on allocations, yields, and risks.

This strategy positions the vault to outperform vanilla staking while safeguarding depositors, with ongoing refinements as Symbiotic evolves.