Delta-Neutral Yield Strategies in Perps

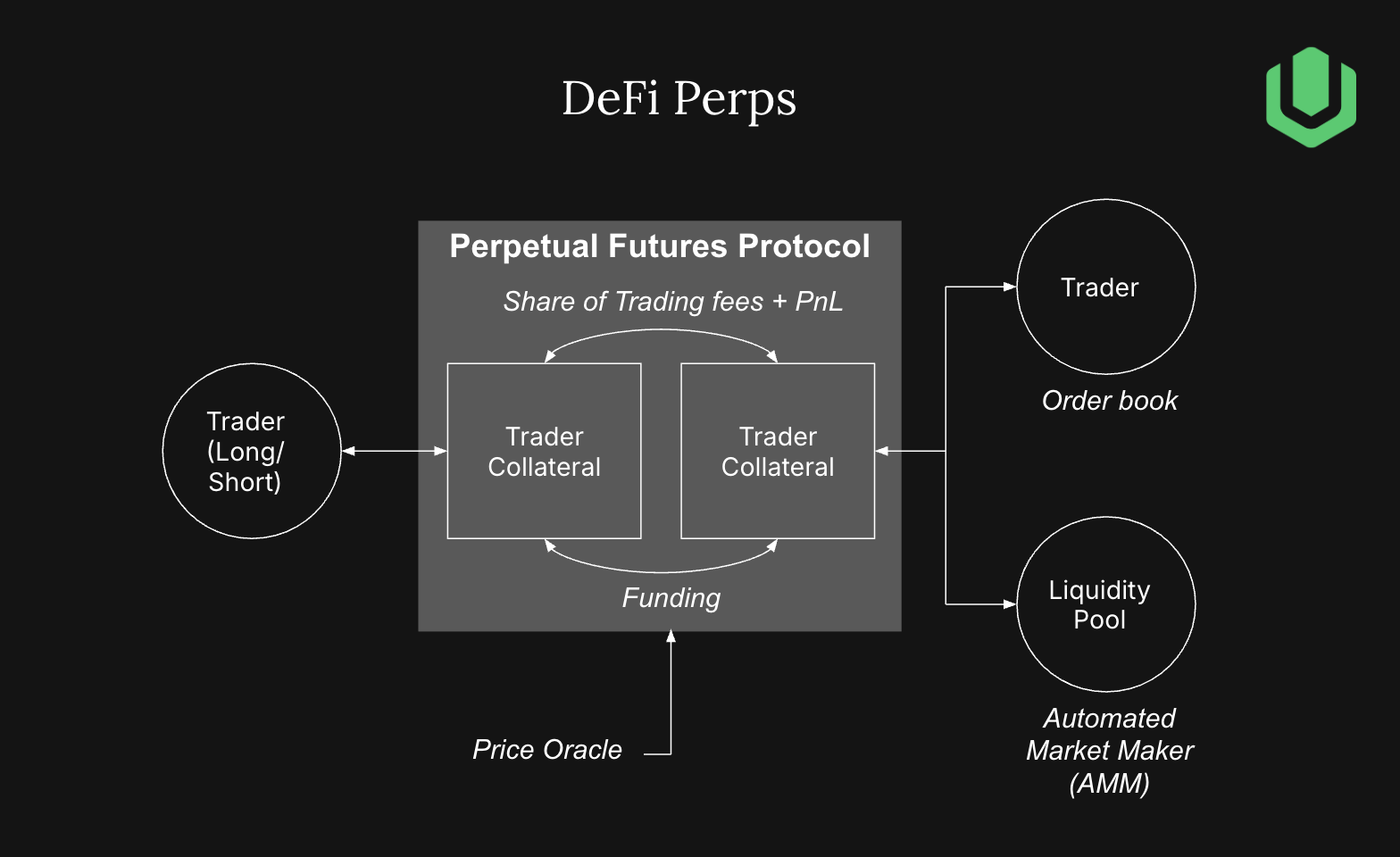

When a trader opens a position on a perp DEX, their trade is matched against either another trader (via orderbook), a liquidity pool (via AMM), or a hybrid system. These design choices affect hedging accuracy, slippage, and rebalancing frequency

Architectural types of perp DEXs:

-

Orderbook (on/off chain): Hyperliquid, dYdX v4, Vertex

-

AMM-based: GMX, Jupiter, Ostium

-

Hybrid: Drift (vAMM + on-chain orderbook)

Hyperliquid — Orderbook Model with Native Liquidity Vault

-

Built on HyperBFT, a custom Layer 1 with HyperEVM

-

Liquidity providers deposit into Hyperliquid Provider (HLP), which absorbs unmatched flow

-

Yield comes from trading fees and funding imbalance

-

Hedging requires querying net open interest via API

-

Transparent, index-based funding rates

GMX — AMM-Based Perpetuals on Arbitrum

-

GM pools act as counterparties to traders

-

Vaults like hedged GLP/GM earn predictable fees but face drift risk

-

Per-asset funding uses borrow-fee based model

-

Suitable for passive vaults and less frequent rebalancing

-

Funding skew determines borrowing cost

Drift — Hybrid Model on Solana

-

Combines virtual AMM (vAMM) and Just-In-Time market making via DLOB

-

Native support for programmable strategy vaults

-

Epoch-based resets for efficient rebalancing

-

Cross-margin and isolated markets allow multi-asset hedging

-

Capped, dynamically tuned funding rates

These models determine whether a hedge earns or pays funding, affecting overall strategy returns.