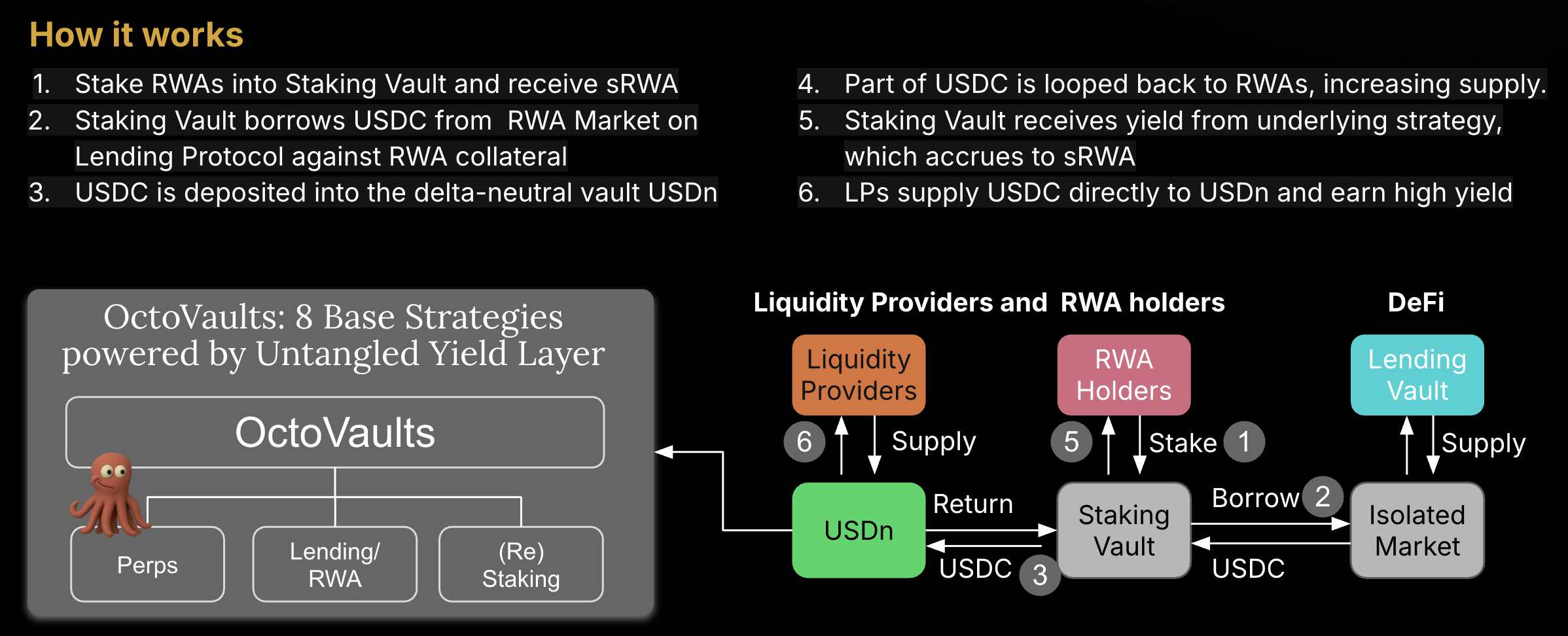

How it works

- Stake RWAs into Staking Vault and receive sRWA

- Staking Vault borrows USDC from RWA Market on Lending Protocol against RWA collateral

- USDC is deposited into the delta-neutral vault USDn

- Part of USDC is looped back to RWAs, increasing supply.

- Staking Vault receives yield from underlying strategy, which accrues to sRWA

- LPs supply USDC directly to USDn and earn high yield

Credio, Untangled’s curation service, acts as a curator on both isolated lending markets and USDn2. Credio employs a proprietary optimisation engine to monitor and rebalance allocations among whitelisted markets. This strategy aims to earn a minimum yield equivalent to what lending protocols like Aave offer. During bull market cycles, the vault allocates more to perps to take advantage of high funding rates. In a market downturn, the vault allocates more to stable return options like Aave or RWAs.

USDn2 is live on Arbitrum mainnet. You can access it here.